The US money supply is the total amount of money in circulation, including currency and deposits. It is divided into several categories, including M1, M2, and M3.

M1 is the narrowest measure of the money supply and includes the most liquid forms of money, such as currency, demand deposits, and other checkable deposits. M2 is a broader measure of the money supply and includes M1 plus savings deposits, money market deposit accounts, and other less liquid forms of money. M3 is the broadest measure of the money supply and includes M2 plus large time deposits, certificates of deposit, and other less liquid forms of money.

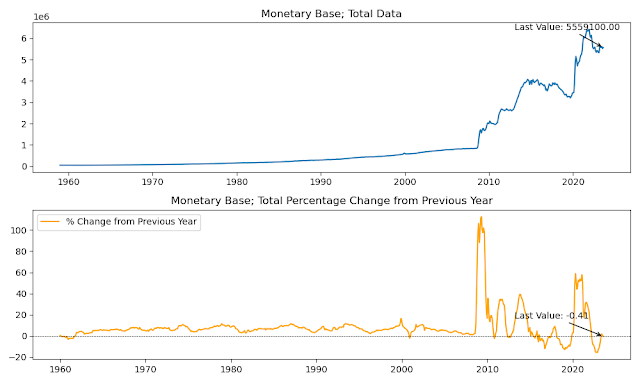

US Money Supply (September 30, 2023)

| Category | Amount (USD Billions) | Last Pct Change |

|---|---|---|

| M1 | 18,320.40 | -10.544485 |

| M2 | 20,865.30 | -3.668530 |

| Currency Component of M1 | 2,242.80 | -0.390833 |

| Monetary Base; Reserve Balances | 3,228,000.00 | -2.356393 |

| Monetary Base; Total | 5,559,100.00 | -0.413815 |

| Monetary Base; Currency in Circulation | 2,331,100.00 | 2.407416 |

| Reserves of Depository Institutions: Total | 3,228.00 | -2.356393 |

| Retail Money Market Funds | 1,611.10 | 53.335871 |

The data above shows that the US money supply decreased across all categories in September 2023. The largest decrease was in M1, which fell by 10.54%. This was followed by M2, which fell by 3.67%. The currency component of M1 fell by 0.39%, while the monetary base fell by 0.41%.

The decrease in the money supply is likely due to a number of factors, including the Federal Reserve's quantitative tightening program and rising interest rates. Quantitative tightening is a process by which the Fed reduces the amount of money in circulation by selling assets from its balance sheet. Rising interest rates make it more expensive to borrow money, which can lead to a decrease in investment and spending.

The decrease in the money supply could have a number of implications for the US economy. It could lead to slower economic growth, lower inflation, and higher unemployment. However, it could also help to reduce the government's budget deficit and make the US economy more resilient to economic shocks.

It is important to note that the money supply is just one indicator of the health of the US economy. Other factors, such as economic growth, unemployment, and inflation, also play an important role.

No comments:

Post a Comment