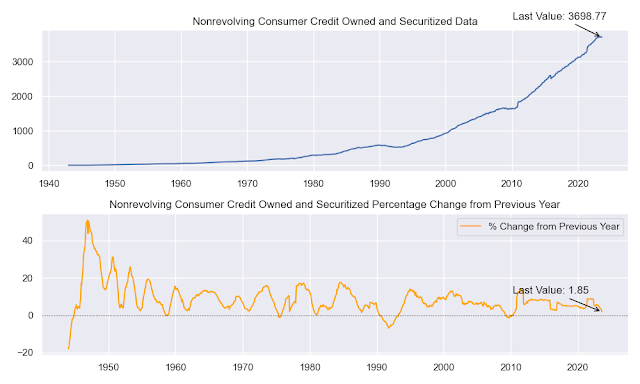

Consumer Credit Percentage Changes from Previous Year

Consumer credit increased at an annual rate of 5.51% in August 2023, driven by an increase in revolving credit, which increased at an annual rate of 13.91%. Nonrevolving credit decreased at an annual rate of 9.8%.

The largest percentage increases in consumer credit were seen in the following categories:

- Revolving Consumer Credit Owned by Credit Unions (+13.91%)

- Revolving Consumer Credit Owned by Depository Institutions (+11.21%)

- Revolving Consumer Credit Owned and Securitized (+10.88%)

- Total Consumer Credit Owned by Credit Unions (+9.39%)

The largest percentage decreases in consumer credit were seen in the following categories:

- Nonrevolving Consumer Credit Owned by Nonprofit Organizations (-12.24%)

- Revolving Consumer Credit Owned by Finance Companies (-4.78%)

- Nonrevolving Consumer Credit Owned by Federal Government (-0.64%)

- Nonrevolving Consumer Credit Owned by Depository Institutions (-0.81%)

What does this mean?

The increase in consumer credit suggests that consumers are continuing to borrow money to spend, despite rising interest rates and inflation. This could be a sign that consumers are confident about the economy and their future financial prospects. However, it could also be a sign that consumers are struggling to make ends meet and are resorting to debt to finance their spending.

The decrease in nonrevolving credit suggests that consumers are paying down existing debt, such as student loans and auto loans. This could be a sign that consumers are taking steps to improve their financial health. However, it could also be a sign that consumers are struggling to afford their monthly payments.

What to watch for in the future

It will be important to monitor consumer credit trends in the coming months to see if the current upward trend continues. If consumer credit continues to grow at a rapid pace, it could put upward pressure on inflation and lead to higher interest rates.

It will also be important to monitor the types of credit that consumers are borrowing. If consumers are increasingly borrowing on revolving credit, such as credit cards, it could be a sign that they are struggling to make ends meet.

Overall, the consumer credit data for August 2023 is mixed. It suggests that consumers are continuing to borrow money to spend, but they are also paying down existing debt. It will be important to monitor consumer credit trends in the coming months to see if the current upward trend continues and to see what types of credit consumers are borrowing.

Source: https://www.federalreserve.gov/releases/g19/

No comments:

Post a Comment