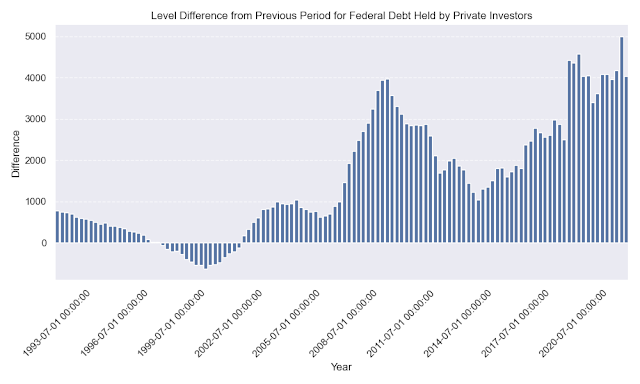

- The total federal debt held by private investors increased by 12.0343%.

- The total federal debt held by the public increased by 6.4704%.

- The total federal debt increased by 5.7696%.

- The federal debt held by private investors as a percent of gross domestic product (GDP) increased by 5.7471%.

- The federal debt held by the public as a percent of GDP increased by 0.4954%.

- The total federal debt as a percent of GDP decreased by 0.1660%.

- The federal debt held by agencies and trusts as a percent of GDP decreased by 2.5520%.

- The federal debt held by foreign and international investors as a percent of GDP decreased by 5.6482%.

- The federal debt held by the Federal Reserve Banks as a percent of GDP decreased by 11.1685%.

- The foreign and international investors' share of the total federal debt decreased by 11.9142%.

- The Federal Reserve Banks' share of the total federal debt decreased by 16.1536%.

Overall, the percentage changes suggest that the total federal debt held by private investors and the public increased in 2023, but the growth was slower than in previous years. The federal debt held by agencies and trusts and foreign and international investors decreased as a percent of GDP, while the Federal Reserve Banks' share of the total federal debt increased.

1. **Increase in Debt Held by Private Investors and the Public:**

- The increase in federal debt held by private investors and the public suggests that the government has been borrowing more from these groups. This could be due to various reasons, including increased government spending, stimulus measures, or lower tax revenues.

- The fact that these increases are significant but slower compared to previous years might indicate a cautious approach towards borrowing or a situation where the government had to reduce its deficit spending.

2. **Debt as a Percent of GDP:**

- The mixed changes in debt as a percent of GDP (some increased, some decreased) indicate differing confidence levels and priorities among various investor groups.

- A decrease in debt as a percent of GDP is generally seen positively, as it suggests that the country's economic output is growing at a pace that outstrips its borrowing. However, the specifics (like which types of debt are shrinking relative to GDP) can also be important.

3. **Decrease in Debt Held by Agencies, Trusts, and Foreign Investors:**

- The reduction in holdings by agencies, trusts, and foreign investors could suggest a shift in their investment strategies, possibly due to better returns elsewhere or a change in risk perception regarding U.S. debt.

- Decreased foreign holding can also have implications for the value of the U.S. dollar. If foreign investors are selling U.S. debt, they might be converting dollars into their local currency, potentially affecting exchange rates.

4. **Decrease in Debt Held by the Federal Reserve Banks:**

- A decrease in the percentage of debt held by the Federal Reserve could indicate a tapering of its bond-buying programs, often used to inject liquidity into the economy. This could signal a tightening of monetary policy, which is typically done if there are inflationary concerns or if the economy is perceived to be strong enough to warrant less intervention.

5. **Changes in Share of Total Federal Debt:**

- The decrease in foreign and international investors' share and Federal Reserve Banks' share of the total federal debt, coupled with an increase in the share held by private investors, suggests a shift in the debt ownership landscape. This could reflect changes in monetary policy, global investor confidence, or domestic economic conditions.

6. **Overall Assessment:**

- The overall picture suggests that while borrowing has increased, it has possibly done so in a more domestically focused manner, with less reliance on foreign investors or institutional purchases by the Federal Reserve. This scenario might reflect an economy recovering or adjusting to new fiscal conditions or policies.

- The decrease in debt held by certain sectors as a percent of GDP, coupled with the overall debt increase, suggests that the economic growth (GDP growth) could be outpacing the rate of new debt accumulation, a potentially positive sign for economic health.

Source:https://fiscaldata.treasury.gov/

.png)

No comments:

Post a Comment