Percentage Changes from Previous Year - Large Bank Credit Card and Mortgage Data

Credit Card Data

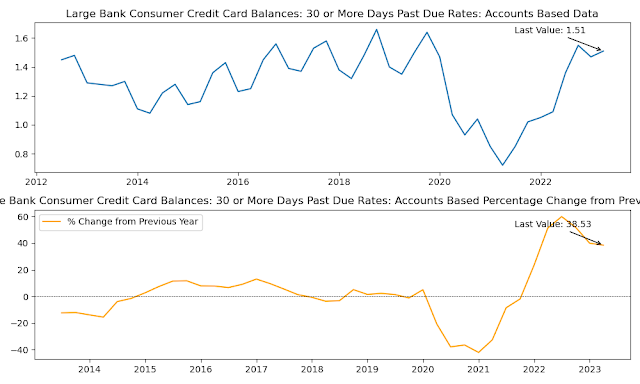

- Large Bank Consumer Credit Card Balances: 30 or More Days Past Due Rates: Accounts Based: +38.53%

- Large Bank Consumer Credit Card Balances: Revolving Balances Only: +19.87%

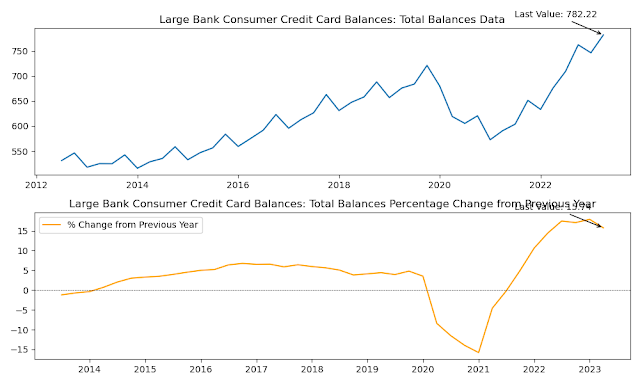

- Large Bank Consumer Credit Card Balances: Total Balances: +15.74%

- Large Bank Consumer Credit Card Balances: Share of Accounts Making the Minimum Payment: +13.42%

- Large Bank Consumer Credit Card Originations: New Originations: +11.56%

- Large Bank Consumer Credit Card Originations: Number of New Accounts: -0.93%

Mortgage Data

- Large Bank Consumer Mortgage Originations: New Originations: -56.20%

- Large Bank Consumer Mortgage Originations: Number of New Accounts: -57.23%

Analysis

The percentage changes from the previous year in large bank credit card and mortgage data show a mixed picture. Credit card balances, delinquencies, and originations all increased, while mortgage originations declined sharply.

The increase in credit card balances is likely due to a number of factors, including rising inflation, supply chain disruptions, and the end of the pandemic stimulus programs. Delinquencies are also on the rise, suggesting that some borrowers are struggling to keep up with their payments.

Mortgage originations, on the other hand, declined sharply in the first quarter of 2023. This is likely due to a number of factors, including rising interest rates, high home prices, and tight inventory.

Overall, the data suggests that the consumer credit market is cooling down. Credit card borrowers are taking on more debt and struggling to keep up with their payments, while mortgage borrowers are finding it more difficult to afford a home.

Source: https://www.philadelphiafed.org/surveys-and-data/large-bank-credit-card-and-mortgage-data

No comments:

Post a Comment