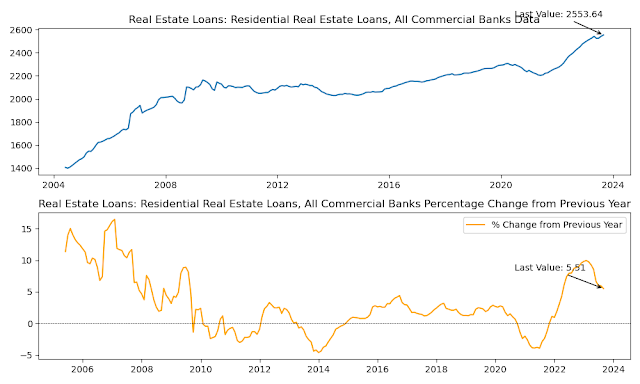

Commercial banks are shifting their asset allocations towards consumer loans and real estate loans. This is evidenced by the fact that the percentage changes for consumer loans (credit cards and other revolving plans) and real estate loans (commercial and residential) are all significantly higher than the percentage change for total assets.

One possible explanation for this is that the strong economic growth that has been seen in the past year is leading to increased demand for consumer loans and real estate loans. Businesses and consumers are more likely to borrow money when the economy is growing and they are confident about their future financial prospects.

Another possible explanation is that the low interest rate environment is making it more affordable for businesses and consumers to borrow money. This has likely led to increased demand for both consumer loans and real estate loans.

The negative percentage changes for commercial and industrial loans, treasury and agency securities, and other securities suggest that these types of assets are declining in value or being sold by commercial banks. This could be due to a number of factors, such as rising interest rates, concerns about a recession, or changes in investment strategy.

Overall, the data suggests that commercial banks are shifting their asset allocations towards consumer loans and real estate loans, as these types of assets are growing at a faster rate than other types of assets. This could be a reflection of the strong economic growth and low interest rate environment that has been seen in the past year.

Here are some of the potential implications of this shift in asset allocations:

- Increased consumer spending: Consumer loans can be used to finance a variety of purchases, such as new cars, homes, and appliances. When commercial banks make more consumer loans, it can boost consumer spending and economic growth.

- Higher housing prices: Real estate loans are used to finance the purchase of homes and other properties. When commercial banks make more real estate loans, it can drive up housing prices.

- Increased risk: Consumer loans and real estate loans can be riskier than other types of loans, such as commercial and industrial loans. This is because consumers and homeowners are more likely to default on their loans if they experience financial hardship.

.png)

.png)

No comments:

Post a Comment