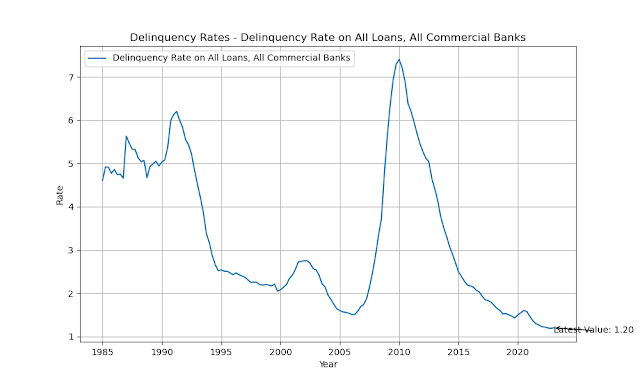

The following charts depict the historical delinquency rates on various types of loans across all commercial banks. Overall, most delinquency rates, including those for all loans, mortgage loans, real estate loans, and business loans, are currently at historical lows. However, the delinquency rates on credit card and consumer loans reached their lowest points but have since begun to rise again, nearing pre-pandemic levels. Specifically, the delinquency rates on credit card loans have risen to 2.43%, nearly reaching the same level as before the pandemic.

My objective is to simplify and clarify economics, making it accessible to everyone. It is important to remember that the opinions expressed in my writing are solely my own and should not be considered as financial advice. Any potential losses incurred from acting upon the information provided in my writing are the responsibility of the individual, and I cannot be held liable for them.

Translate

Sunday, June 4, 2023

Delinquency Rates on different types of loans by All Commercial Banks

Labels:

#banks#lending

Subscribe to:

Post Comments (Atom)

,%20Booked%20in%20Domestic%20Offices,%20All%20Commercial%20Banks_plot.png)

No comments:

Post a Comment