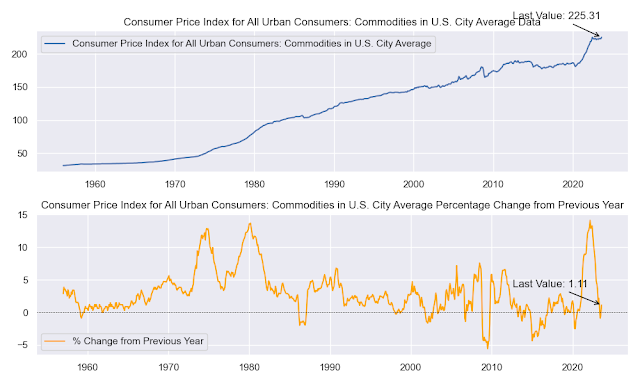

The summary of the Consumer Price Index for All Urban Consumers (CPI-U) for August 2023:

- The CPI-U rose 0.6% in August, after rising 0.2% in July.

- The 12-month increase was 3.7%, up from 3.2% in July.

- The energy index rose 5.6% in August, after rising 0.1% in July.

- The food index rose 0.2% in August, after rising 0.2% in July.

- The all items less food and energy index rose 0.3% in August, after rising 0.2% in July.

The largest contributors to the monthly increase in the CPI-U were:

- Gasoline, which rose 10.6%

- Shelter, which rose 0.3%

- Motor vehicle insurance, which rose 2.4%

The largest contributors to the 12-month increase in the CPI-U were:

- Shelter, which rose 7.3%

- Energy, which fell 3.6%

- Food, which rose 4.3%

The CPI-U is a measure of the prices of goods and services purchased by urban consumers. It is used to track inflation. The August 2023 CPI-U report shows that inflation is continuing to rise, but at a slower pace than in recent months. The 12-month increase of 3.7% is still above the Federal Reserve's target of 2%, but it is down from the 4.2% increase in July.

The main drivers of inflation in August were gasoline and shelter. Gasoline prices rose sharply in August, due to increased demand and supply constraints. Shelter prices also rose, as rents and home prices continued to increase. Food prices rose at a slower pace in August, but they are still up over the past year.

The slowing pace of inflation is a positive development, but it is too early to say whether it is a trend. The Federal Reserve is expected to continue raising interest rates in an effort to cool inflation. However, the impact of these rate hikes will take time to be felt.

In the meantime, consumers should be prepared for continued inflation, and they should make sure they are not overspending. They should also shop around for the best prices on goods and services.

Source: https://www.bls.gov/news.release/cpi.nr0.htm

No comments:

Post a Comment