- Copper: The global price of copper rose by 12.35%. This is the largest one-day increase in copper prices since March 2020. The rise in copper prices is due to concerns about a global supply shortage.

- Iron ore: The global price of iron ore rose by 4.52%. This is the third consecutive day of gains for iron ore prices. The rise in iron ore prices is due to strong demand from China.

- Nickel: The global price of nickel fell by 1.82%. This is the first decline in nickel prices in three days. The decline in nickel prices is due to profit-taking after a sharp rally in recent weeks.

- US regular all formulations gas price: The US regular all formulations gas price fell by 3.39%. This is the fifth consecutive day of declines for gas prices. The decline in gas prices is due to a slowdown in demand in the United States.

- Global food index: The global food index fell by 3.96%. This is the largest one-day decline in the food index since March 2020. The decline in the food index is due to a combination of factors, including lower prices for corn, wheat, and soybeans.

- Aluminum: The global price of aluminum fell by 10.33%. This is the largest one-day decline in aluminum prices since March 2020. The decline in aluminum prices is due to concerns about a global economic slowdown.

- Crude oil prices: The price of crude oil fell by 13.11% and 14.24% for WTI and Brent crude, respectively. This is the largest one-day decline in crude oil prices since April 2020. The decline in crude oil prices is due to concerns about a global economic slowdown and a slowdown in demand in China.

- Rubber: The global price of rubber fell by 17.92%. This is the largest one-day decline in rubber prices since March 2020. The decline in rubber prices is due to concerns about a global economic slowdown.

- Corn: The global price of corn fell by 24.76%. This is the largest one-day decline in corn prices since March 2020. The decline in corn prices is due to concerns about a global economic slowdown and a slowdown in demand in China.

- WTI crude: The price of WTI crude fell by 25.66%. This is the largest one-day decline in WTI crude prices since April 2020. The decline in WTI crude prices is due to concerns about a global economic slowdown and a slowdown in demand in China.

- Barley: The global price of barley fell by 28.04%. This is the largest one-day decline in barley prices since March 2020. The decline in barley prices is due to concerns about a global economic slowdown and a slowdown in demand in China.

- Average price: Eggs, grade A, large (cost per dozen): The average price of eggs fell by 28.68%. This is the largest one-day decline in egg prices since March 2020. The decline in egg prices is due to concerns about a global economic slowdown and a slowdown in demand in China.

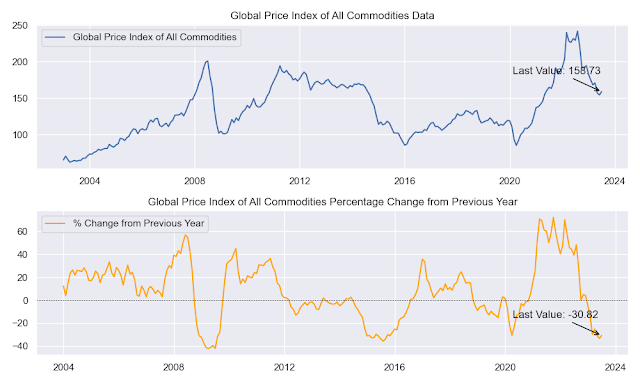

- Global price index of all commodities: The global price index of all commodities fell by 30.82%. This is the largest one-day decline in the global price index of all commodities since March 2020. The decline in the global price index of all commodities is due to concerns about a global economic slowdown.

- Global price of energy index: The global price of energy index fell by 49.11%. This is the largest one-day decline in the global price of energy index since March 2020. The decline in the global price of energy index is due to concerns about a global economic slowdown and a slowdown in demand in China.

- Global price of LNG, Asia: The global price of LNG, Asia fell by 73.57%. This is the largest one-day decline in the global price of LNG, Asia since March 2020. The decline in the global price of LNG, Asia is due to concerns about a global economic slowdown and a slowdown in demand in China.

My objective is to simplify and clarify economics, making it accessible to everyone. It is important to remember that the opinions expressed in my writing are solely my own and should not be considered as financial advice. Any potential losses incurred from acting upon the information provided in my writing are the responsibility of the individual, and I cannot be held liable for them.

Translate

Friday, September 8, 2023

Commodities Prices as of June 2023

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment