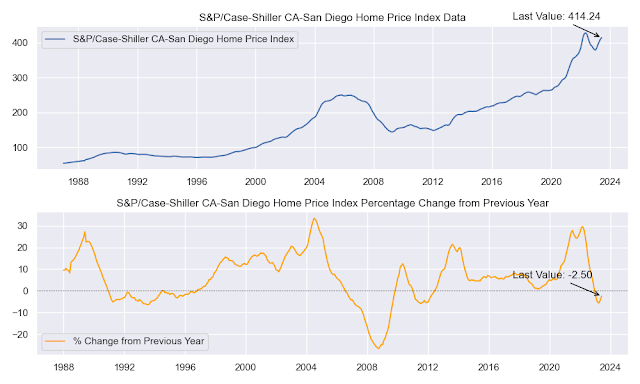

As you can see, the housing market is starting to cool down across the United States. The national home price index declined by 0.02% in the latest month, and the 10-city and 20-city composite indices both declined by 0.47% and 1.17%, respectively.

The biggest declines were in the western United States, where home prices in Los Angeles, San Diego, and Las Vegas all declined by more than 8%. The only cities that saw an increase in home prices were Chicago and New York.

There are a number of factors that are contributing to the cooling housing market, including rising interest rates, inflation, and concerns about a potential recession. Rising interest rates make it more expensive to borrow money, which can cool demand for housing. Inflation is also making it more expensive to buy a home, as the cost of everything from materials to labor is rising. And concerns about a potential recession could lead some buyers to delay their purchase or even sell their homes.

It is still too early to say whether the cooling housing market is the start of a longer-term trend. However, the recent data suggests that the market is starting to adjust to higher interest rates and inflation. This could be good news for buyers, as it could lead to more affordable home prices in the future.

No comments:

Post a Comment