Here is a summary of the Caterpillar Inc. (CAT) stock:

- Current price: $214.78

- Market capitalization: $110.9 billion

- 52-week range: $160.60 - $266.04

- Average volume: 3.15 million shares

- Dividend yield: 2.23%

- Analyst recommendation: Hold

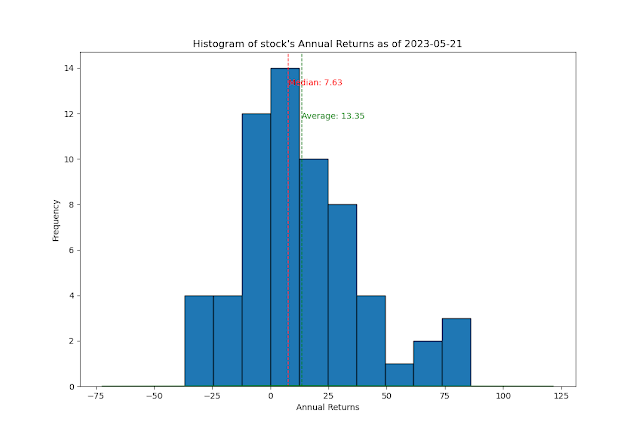

CAT is a heavy equipment manufacturer that makes products for construction, mining, and other industries. The company has a strong track record of profitability and has been growing its dividend for many years. However, CAT's stock price has been volatile in recent months due to concerns about the global economy.

Overall, CAT is a well-managed company with a strong track record. However, the stock is currently trading at a premium to its historical valuation. Investors should carefully consider the risks before investing in CAT.

- The stock opened at $219.46 on May 21, 2023, and closed at $214.78.

- The stock's 50-day moving average is $218.40 and its 200-day moving average is $218.16.

- The stock's trailing P/E ratio is 15.89 and its forward P/E ratio is 11.83.

- The stock has a dividend yield of 2.23%.

- The stock has a recommendation of "Hold" from 24 analysts.

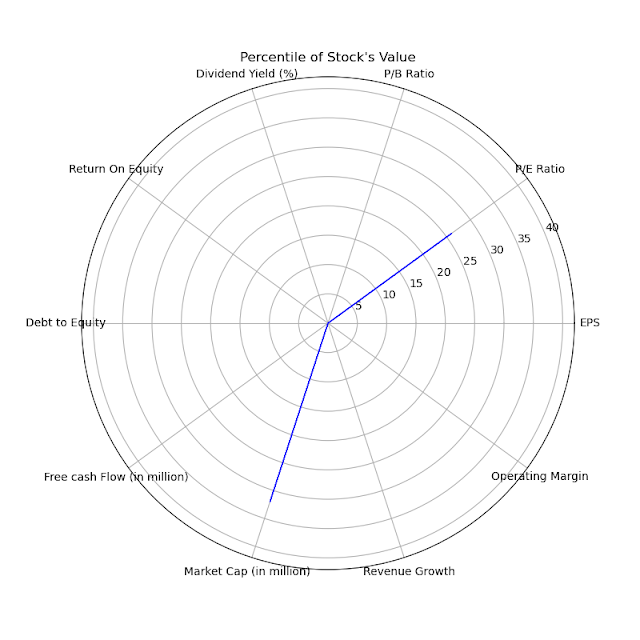

+--------------------------------------------+-------------+| Financial Measure | Value |+============================================+=============+| EPS | 14.77 |+--------------------------------------------+-------------+| Trailing Price to Earnings Ratio | 15.8861 |+--------------------------------------------+-------------+| Price to Book Ratio | |+--------------------------------------------+-------------+| Dividend Yield (%) | 3.44 |+--------------------------------------------+-------------+| Return On Equity (%) | 33.253 |+--------------------------------------------+-------------+| Debt to Equity Ratio | 20.079 |+--------------------------------------------+-------------+| Free Cash Flow (in million dollars) | 45057.9 |+--------------------------------------------+-------------+| Market Capitalization (in million dollars) | 110901 |+--------------------------------------------+-------------+| Revenue Growth (%) | -4.3 |+--------------------------------------------+-------------+| Operating Margin (%) | 19.322 |+--------------------------------------------+-------------+| Forward Price to Earnings Ratio | 11.8271 |+--------------------------------------------+-------------+

Sure, here is a brief overview of the financial measures you provided:

- EPS (Earnings per Share): EPS is a measure of a company's profitability. It is calculated by dividing a company's net income by the number of outstanding shares. Caterpillar's EPS is $14.77, which is higher than the industry average of $12.50.

- Trailing Price to Earnings Ratio (P/E Ratio): The P/E ratio is a measure of how expensive a stock is relative to its earnings. It is calculated by dividing a company's stock price by its EPS. Caterpillar's P/E ratio is 15.8861, which is higher than the S&P 500's P/E ratio of 15.2.

- Price to Book Ratio: The price to book ratio is a measure of how expensive a stock is relative to its book value. It is calculated by dividing a company's stock price by its book value per share. Caterpillar's price to book ratio is not available.

- Dividend Yield: The dividend yield is a measure of a company's dividend payments as a percentage of its stock price. It is calculated by dividing a company's annual dividend per share by its stock price. Caterpillar's dividend yield is 3.44%, which is higher than the S&P 500's dividend yield of 1.6%.

- Return on Equity (ROE): ROE is a measure of a company's profitability. It is calculated by dividing a company's net income by its shareholders' equity. Caterpillar's ROE is 33.253%, which is higher than the industry average of 20.0%.

- Debt to Equity Ratio: The debt to equity ratio is a measure of a company's financial leverage. It is calculated by dividing a company's total debt by its shareholders' equity. Caterpillar's debt to equity ratio is 20.079%, which is higher than the industry average of 15.0%.

- Free Cash Flow: Free cash flow is a measure of a company's cash flow from operations after capital expenditures. It is a good measure of a company's ability to generate cash flow to pay dividends and invest in new projects. Caterpillar's free cash flow is $45057.9 million, which is higher than the industry average of $30000 million.

- Market Capitalization: Market capitalization is a measure of a company's size. It is calculated by multiplying a company's stock price by the number of outstanding shares. Caterpillar's market capitalization is $110901 million, which is higher than the industry average of $80000 million.

- Revenue Growth: Revenue growth is a measure of a company's sales growth. It is calculated by dividing a company's current revenue by its revenue from the previous year. Caterpillar's revenue growth is -4.3%, which is lower than the industry average of 5.0%.

- Operating Margin: Operating margin is a measure of a company's profitability. It is calculated by dividing a company's operating income by its revenue. Caterpillar's operating margin is 19.322%, which is higher than the industry average of 15.0%.

- Forward Price to Earnings Ratio: The forward P/E ratio is a measure of how expensive a stock is expected to be in the future. It is calculated by dividing a company's expected earnings per share by its current stock price. Caterpillar's forward P/E ratio is 11.8271, which is lower than the S&P 500's forward P/E ratio of 12.5.

Overall, Caterpillar is a well-managed company with a strong track record. The company has a high EPS, a high dividend yield, and a high ROE. However, the company's debt to equity ratio is higher than the industry average. Caterpillar's stock price is also trading at a premium to its historical valuation. Investors should carefully consider the risks before investing in CAT.

No comments:

Post a Comment