Amgen's products are used by millions of patients around the world, and the company has a strong track record of research and development. In recent years, Amgen has made significant investments in new technologies, such as gene editing and cell therapy, and it is well-positioned to continue to bring innovative medicines to patients in the years to come.

Amgen is a global company with operations in over 100 countries. It employs over 22,000 people worldwide, and it is committed to providing patients with access to high-quality, affordable medicines. Amgen is also a strong advocate for patient care and research, and it is a member of a number of patient advocacy organizations.

Amgen is a leading force in the biotechnology industry, and it is committed to making a difference in the lives of patients around the world.

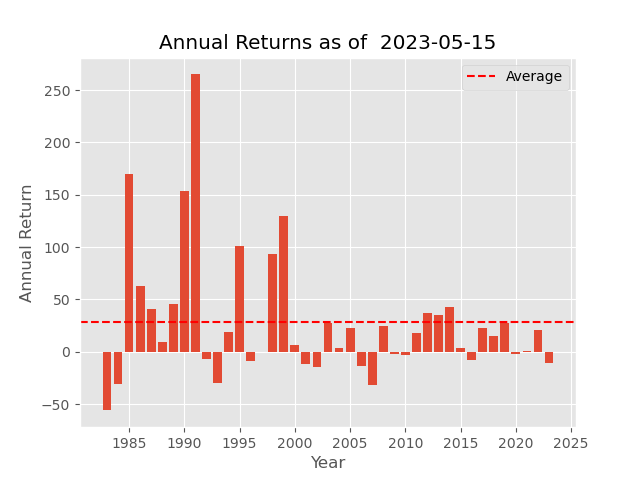

Here is a breakdown of some financial measures for Amgen Inc. (AMGN):

-

EPS (Earnings Per Share): The EPS for Amgen is 14.7, indicating the company's profitability per share.

- Price to Earnings Ratio: The Price to Earnings (P/E) ratio for Amgen is 15.8469. This ratio compares the company's stock price to its earnings and provides insights into the valuation of the company's shares.

- Price to Book Ratio: The Price to Book (P/B) ratio for Amgen is 23.2741. This ratio compares the market price of a company's stock to its book value per share, indicating the premium investors are willing to pay for each dollar of net assets.

- Dividend Yield: Amgen has a dividend yield of 3.66%, which represents the annual dividend payments as a percentage of the stock's current market price.

- Return On Equity: The Return On Equity (ROE) for Amgen is 252.778%. This metric measures the profitability of a company in relation to the shareholders' equity and indicates the efficiency of utilizing shareholder investments.

- Debt to Equity Ratio: The Debt to Equity ratio for Amgen is 1151.74, reflecting the company's level of debt relative to its equity. A higher ratio suggests higher financial leverage.

- Free Cash Flow: Amgen generated $7,955 million in free cash flow. Free cash flow represents the cash a company generates after accounting for capital expenditures and is an important measure of a company's financial health.

- Market Capitalization: The market capitalization of Amgen is $125,091 million, representing the total value of the company's outstanding shares in the market.

- Revenue Growth: Amgen experienced a revenue growth rate of -2.1%. This measure indicates the change in revenue compared to the previous period.

- Operating Margin: The operating margin for Amgen is 36.831%. This margin represents the company's operating income as a percentage of its revenue and reflects its operational efficiency.

Please note that these financial measures are based on the available information and are subject to change over time. It's always recommended to refer to the latest financial reports and disclosures for the most accurate and up-to-date information.

The following spider web chart illustrates the performance measures of Amgen stock

No comments:

Post a Comment