The Maximum Sharpe Ratio Portfolio Allocation is a portfolio allocation strategy that aims to maximize the risk-adjusted return of a portfolio. It does so by finding the allocation of assets that provides the highest Sharpe Ratio, which is a measure of the excess return per unit of risk.

In the given information, we have two portfolio allocations: the Maximum Sharpe Ratio Portfolio Allocation and the Minimum Volatility Portfolio Allocation. Let's analyze each of them:

1. Maximum Sharpe Ratio Portfolio Allocation:

- Annualized Return: 0.45

- Annualized Volatility: 0.37

- Allocation:

- AMD: 0.0%

- AVGO: 66.56%

- INTC: 0.0%

- MU: 0.0%

- NVDA: 33.44%

- NXPI: 0.0%

- QCOM: 0.0%

- TSM: 0.0%

This allocation provides an annualized return of 0.45 and an annualized volatility of 0.37. It allocates 66.56% of the portfolio to AVGO, 33.44% to NVDA, and leaves the other stocks with a 0% allocation.

2. Minimum Volatility Portfolio Allocation:

- Annualized Return: 0.16

- Annualized Volatility: 0.29

- Allocation:

- AMD: 0.0%

- AVGO: 42.88%

- INTC: 33.34%

- MU: 0.0%

- NVDA: 0.0%

- NXPI: 0.0%

- QCOM: 0.0%

- TSM: 23.78%

This allocation provides a lower annualized return of 0.16 but also lower annualized volatility of 0.29. It allocates 42.88% of the portfolio to AVGO, 33.34% to INTC, and 23.78% to TSM, with the remaining stocks having a 0% allocation.

To further understand these allocations, let's also consider the individual stock returns and volatilities:

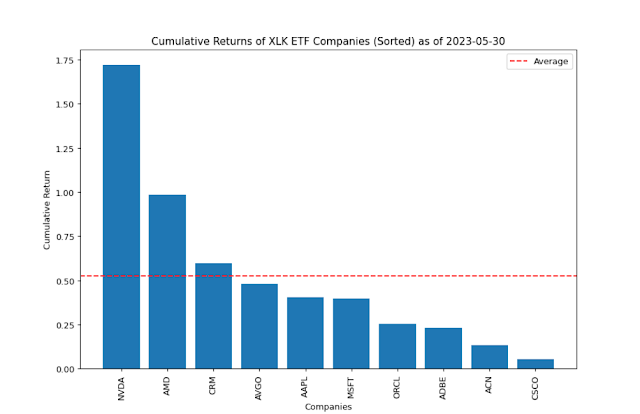

- AMD: Annualized Return: 0.28, Annualized Volatility: 0.51

- AVGO: Annualized Return: 0.37, Annualized Volatility: 0.32

- INTC: Annualized Return: -0.11, Annualized Volatility: 0.35

- MU: Annualized Return: 0.25, Annualized Volatility: 0.43

- NVDA: Annualized Return: 0.6, Annualized Volatility: 0.55

- NXPI: Annualized Return: 0.22, Annualized Volatility: 0.4

- QCOM: Annualized Return: 0.09, Annualized Volatility: 0.4

- TSM: Annualized Return: 0.16, Annualized Volatility: 0.3

These values represent the annualized returns and volatilities for each individual stock.

In summary, the Maximum Sharpe Ratio Portfolio Allocation aims to maximize the risk-adjusted return by allocating a majority of the portfolio to AVGO and NVDA, while minimizing exposure to other stocks. The Minimum Volatility Portfolio Allocation, on the other hand, prioritizes reducing volatility by allocating a significant portion to AVGO, INTC, and TSM, while minimizing exposure to other stocks. The final choice between these two allocations depends on the investor's risk appetite and investment objectives.