Understanding the Ebb and Flow of Federal Finances: Insights from the November 2023 Treasury Statement

The fiscal health of a nation can often be read through the lines of its financial statements. The latest Treasury statement as of November 2023 offers a revealing snapshot of the United States' economic heartbeat, particularly through the lens of the federal budget's surplus or deficit and the various means of financing.

A Deepening Deficit

At first glance, the figures are stark: a monumental monthly decrease in the deficit by 291.56%, alongside a 60.21% annual decline. This indicates that the government's deficit is not only widening at a precipitous rate month-over-month but also year-over-year. Such a shift suggests increased government spending or decreased revenue—or a combination of both—which could be a response to current economic pressures or a deliberate policy choice to stimulate growth.

Spending and Receipts: A Balancing Act

The total federal outlays show a contrasting trend: a significant monthly surge of 229.31% against an annual decrease of 30.41%. This juxtaposition points to a recent spike in government spending which could be related to extraordinary expenditures such as emergency relief funds or significant investment in infrastructure. Despite this surge, the annual decrease suggests a longer-term trend of spending restraint or a previous period of unusually high expenditures.

Conversely, total federal receipts have increased by 65.11% from the previous month, indicating a healthy uptick in revenue collection. However, the annual decrease of 4.15% could signal challenges in sustaining revenue streams or reflect tax cuts or credits that have reduced the inflow.

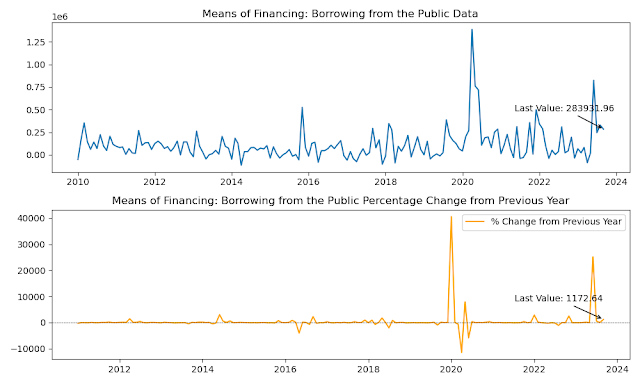

Borrowing Dynamics

The means of financing the deficit show the most dramatic shifts. Borrowing from the public has decreased by 13.51% on a monthly basis, yet it has skyrocketed by 1,172.64% annually. This dramatic annual increase points to a heavy reliance on public borrowing compared to the previous year, which could be due to lower-than-expected revenue streams or higher-than-anticipated expenditures.

Other Means of Financing

Financing by other means has seen a precipitous drop both monthly (100.56%) and annually (99.44%), suggesting that alternative financing methods have been largely abandoned or completed in the current fiscal period.

Cash Operations

Lastly, the increase in means of financing through the reduction of operating cash shows a significant monthly rise of 187.51%, but a staggering annual decrease of 439.19%. This could reflect a strategic use of cash reserves in the short term, possibly to fund immediate government obligations or investments.

.png)

No comments:

Post a Comment