The Federal Reserve Bank of Boston recently published an insightful piece on the relationship between interest expenses, coverage ratios, and firm distress. This article delves into the intricate dynamics of how these financial aspects interact and influence the overall health of firms. Here's a breakdown of the key points and insights from this publication:

Interest Expenses and Coverage Ratio: These are crucial indicators of a firm's financial health. Interest expenses refer to the cost incurred by a firm for borrowed funds, while the coverage ratio is a measure of a firm's ability to meet its interest obligations.

Firm Distress: This term relates to the challenges a firm faces when it struggles to meet its financial obligations, including interest payments, which can lead to broader economic implications.

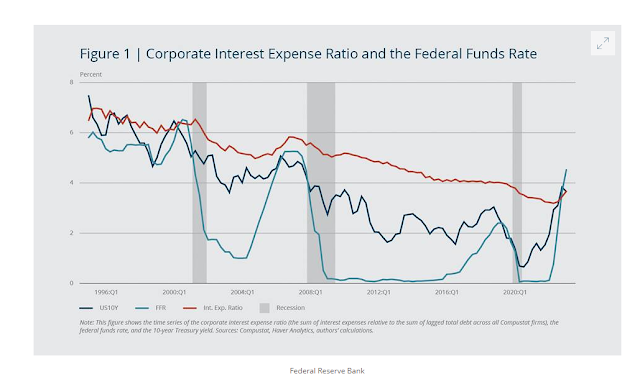

The Boston Fed's analysis on corporate interest expenses and monetary policy reveals several key insights. Firstly, the corporate interest expense ratio, which reflects the average cost of debt funding, has generally declined over the years, consistent with the overall decrease in interest rates. However, the pass-through of changes in the federal funds rate (FFR) to this ratio is incomplete, partly due to the small proportion of floating-rate debt and staggered refinancing patterns. During the COVID-19 pandemic, the issuance of more fixed-rate bonds further delayed this pass-through.

Despite historically low levels, the corporate interest expense ratio began to rise in the second half of 2023, indicating that the recent steep increases in the FFR are starting to impact firms' borrowing costs. This change prompts questions about the historical effects of FFR changes on this ratio. Research using data from 1995 to 2019 shows that a 1 percentage point increase in the FFR leads to about a 0.5 percentage point increase in the corporate interest expense ratio, with a gradual peak effect after five quarters.

The study also highlights firms' growing concerns about interest expenses, as evidenced by their earnings call statements. A risk score based on the frequency of phrases related to interest expenses and risk shows an increase in concern, especially with the recent rate hikes. Furthermore, the current monetary policy tightening cycle has implications for firms' interest coverage ratio (ICR), a key financial performance measure. An increase in interest expenses can lead to covenant violations, which have significant consequences, including technical default. The study projects a significant increase in the share of debt at risk of default under various income scenarios for 2023, drawing parallels to the levels seen during the COVID-19 pandemic and the Great Financial Crisis.

Implications and Relevance:

Understanding these dynamics is crucial for policymakers, investors, and economists. It helps in assessing the financial stability of firms and the broader economic implications of their distress.

The insights from this publication are particularly relevant in times of economic uncertainty, where interest rates and financial health of firms are closely monitored.

For businesses, these concepts are vital for strategic financial planning and risk management.

Conclusion:

The Federal Reserve Bank of Boston's publication offers a comprehensive look at the interplay between interest expenses, coverage ratios, and firm distress. It underscores the importance of these financial indicators in understanding the economic health of firms and, by extension, the broader economy.

For a detailed read and further insights, visit the Boston Fed's publication.

No comments:

Post a Comment