In early April 2025, the U.S. Treasury market was shaken by the announcement of new tariffs by President Donald Trump, including a sweeping 10% baseline tariff and a sharp 145% tariff on Chinese goods. Within days, 10-year Treasury yields surged from under 4% to over 4.5%, sparking concerns over inflation, foreign bondholder behavior, and policy missteps.

As yields climbed, one question dominated Wall Street and Washington: Can the U.S. government prevent or manage such volatility in Treasury yields—especially during politically driven trade shocks?

The Toolkit: Six Ways to Calm the Bond Market

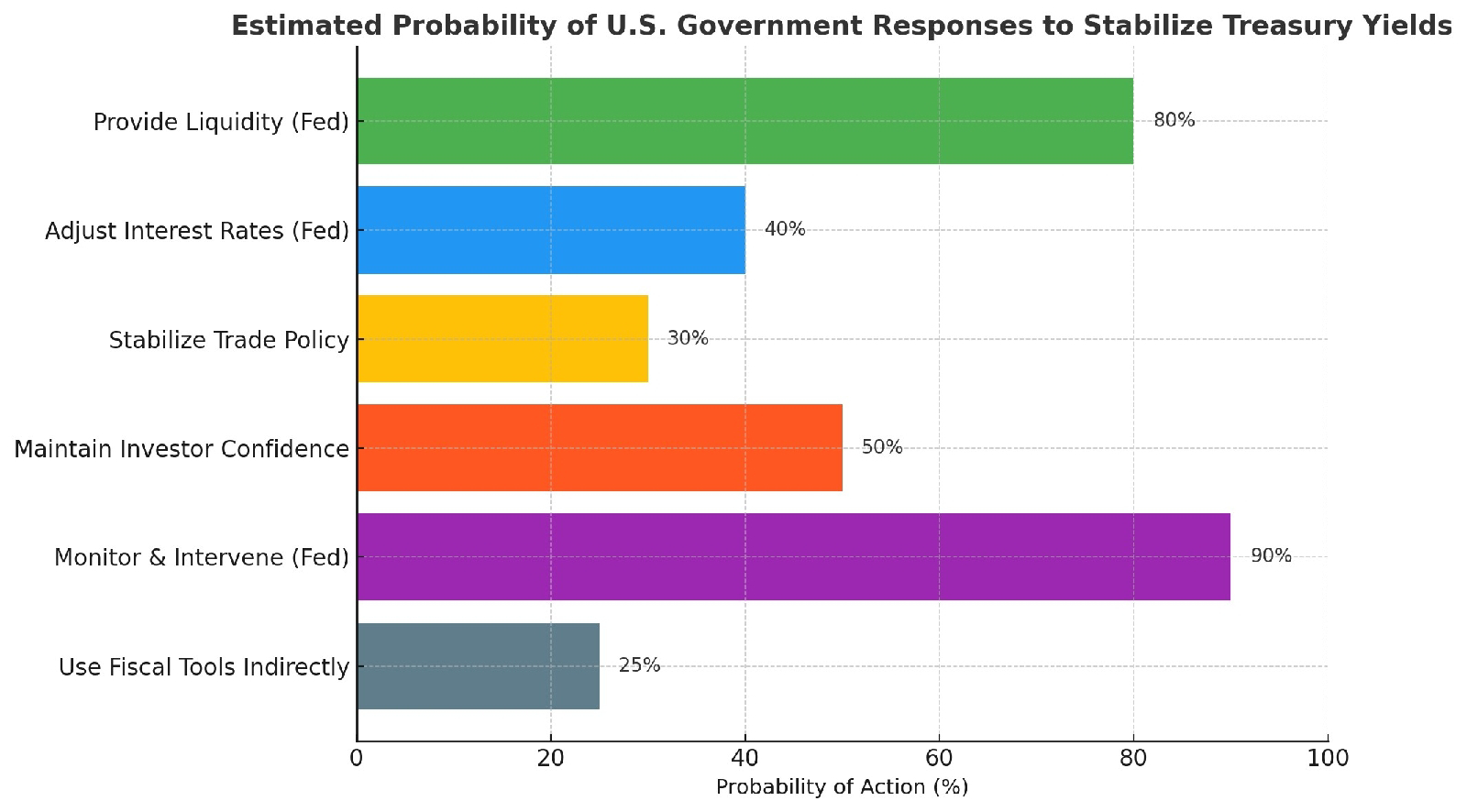

To answer that question, we assessed six potential actions the U.S. government (especially the Federal Reserve) can take to stabilize yields during moments of economic stress. Below is a summary of these policy responses, followed by our estimated probability that each will be deployed.

1. Provide Liquidity (Fed)

Probability: 80%

The Fed can inject liquidity into the market by buying Treasury securities (quantitative easing) or using repurchase agreements. This boosts demand for bonds and lowers yields. It’s a classic and effective tool—and the Fed has used it in virtually every crisis since 2008.

2. Adjust Interest Rates (Fed)

Probability: 40%

Lowering rates can make Treasuries more attractive and drive down yields. However, if inflation is also rising—as it often does during tariff periods—this option becomes politically and economically risky.

3. Stabilize Trade Policy

Probability: 30%

Clear, predictable trade policy reduces uncertainty and restores market calm. For example, the 90-day tariff pause on April 9 temporarily lowered yields. But given the political nature of tariffs, this option is less likely under a protectionist agenda.

4. Maintain Investor Confidence

Probability: 50%

Major holders like China and Japan own trillions in U.S. debt. Their decisions to hold or sell can impact yields. Diplomatic and economic reassurances are key to preventing large-scale bond selloffs.

5. Monitor & Intervene (Fed)

Probability: 90%

The Fed watches bond markets closely and often acts when funding stress emerges. Tools like swap lines, reverse repos, and short-term interventions help maintain market stability. This is the most dependable response.

6. Use Fiscal Tools Indirectly

Probability: 25%

Fiscal tools like bailouts or subsidies can help industries hurt by tariffs, maintaining economic stability and investor confidence. However, they are politically sensitive and usually reserved for deep crises.

Conclusion: Expect the Fed to Act First

While the White House may drive trade tensions, it’s the Federal Reserve that will most likely act to stabilize the bond market. Providing liquidity and monitoring funding stress are well within the Fed’s toolkit—and historically effective.

Still, monetary tools have limits. Without clear trade policy and stable global investor confidence, even the Fed can only do so much. The April 2025 spike in yields was a reminder that markets react not only to interest rates—but to uncertainty.

As inflation pressures, global debt dynamics, and political trade battles evolve, so too must the government’s playbook. For now, the Fed remains the bond market’s first line of defense.

Sources: Federal Reserve releases, CNBC, Reuters, Bloomberg, Atlantic Council, New York Times.

No comments:

Post a Comment