In the dynamic world of enterprise technology, NetApp, Inc. (NASDAQ: NTAP) stands out as a company with a solid financial foundation, consistent growth, and a commitment to shareholder value. With a focus on data management and storage solutions, NetApp has been navigating the evolving landscape of cloud computing and digital transformation successfully.

A Closer Look at NetApp's Financials:

NetApp's recent financial statements paint a picture of a company on a steady growth trajectory. From 2020 to 2023, the company's total assets expanded from $7.5 billion to $9.8 billion, while its revenue grew from $5.4 billion to $6.4 billion. This growth has been accompanied by stable gross profit margins around 66.8%, indicating effective cost management and pricing power.

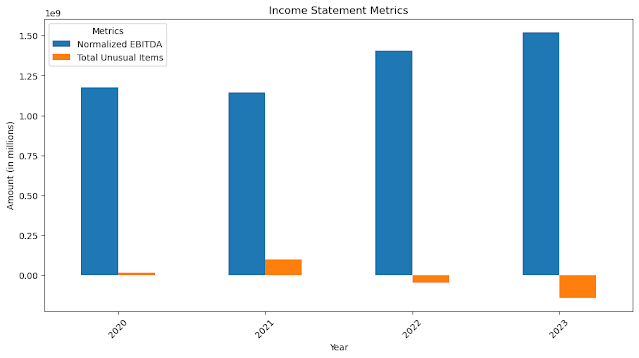

The company's profitability has also been impressive, with operating income increasing from $928 million to $1.2 billion and net income rising from $819 million to $1.3 billion over the same period. NetApp's diluted earnings per share (EPS) have followed suit, growing from $3.52 in 2020 to $5.79 in 2023.

Strong Cash Flow and Shareholder Returns:

One of NetApp's key strengths is its ability to generate robust cash flows. The company has consistently delivered operating cash flows exceeding $1.1 billion annually and free cash flow surpassing $868 million. This strong cash generation has allowed NetApp to invest in its business through acquisitions (over $1.2 billion from 2020 to 2023) and research and development while also returning significant capital to shareholders.

NetApp has allocated $3 billion to share repurchases over the past four years and maintained a regular dividend payout. This commitment to shareholder returns underscores the company's confidence in its financial stability and future prospects.

Valuation and Growth Prospects:

Despite its solid fundamentals, NetApp's stock currently trades at a premium valuation. With a trailing P/E of 27.25 and a forward P/E of 17.05, investors seem to be pricing in expectations of continued growth. The company's price-to-sales (4.14) and price-to-book (22.68) ratios also suggest a relatively high valuation compared to some industry peers.

However, NetApp's strong return metrics, including an 8.04% return on assets and an 85.55% return on equity, indicate the company's efficiency in deploying capital and generating profits. Investors should note that the high ROE is partly influenced by NetApp's significant leverage, with a debt-to-equity ratio of 231.41%.

Looking ahead, NetApp's revenue growth of 5.5% and earnings growth of 22.4% (year-over-year) suggest continued business expansion. As organizations increasingly prioritize data management and storage in the cloud era, NetApp seems well-positioned to capitalize on these trends.

Conclusion:

NetApp's financial statements reveal a company with a solid foundation, consistent growth, and a shareholder-friendly capital allocation strategy. While the company's valuation may appear high, its strong cash flows, profitability, and growth prospects make it an intriguing option for investors seeking exposure to the enterprise technology sector.

As with any investment, it's essential to consider NetApp's financial health alongside factors such as industry dynamics, competitive landscape, and management's ability to execute its strategy. However, based on its recent financial performance and positioning, NetApp appears to be a solid tech play with the potential for continued growth and value creation.

No comments:

Post a Comment