Motorola Solutions (NYSE: MSI) is a global leader in providing public safety and enterprise security solutions. With a history dating back to 1928, the Chicago-based company has established itself as a key player in the communication equipment industry. In this blog post, we will dive deep into Motorola Solutions' financial health and growth prospects, analyzing its balance sheet, cash flow statement, income statement, and key financial ratios.

Company Overview

Motorola Solutions operates in two main segments: Products and Systems Integration, and Software and Services. The company's offerings include a wide range of products and services, such as two-way radios, video security solutions, and command center software. With a workforce of approximately 21,000 employees, Motorola Solutions serves a diverse customer base across various industries, including public safety, government, and enterprise sectors.

Financial Analysis

1. Balance Sheet

Motorola Solutions has demonstrated consistent growth in its total assets, increasing from $10.9 billion in 2019 to $13.3 billion in 2023. However, it is important to note that a significant portion of the company's non-current assets (61% in 2023) consists of goodwill and intangible assets. While this is common in the technology industry, it could pose a risk if these assets are overvalued or impaired in the future.

The company's total liabilities have also increased, primarily due to a rise in long-term debt. Despite this, Motorola Solutions has managed to improve its stockholders' equity from a negative $558 million in 2019 to a positive $724 million in 2023, indicating an improvement in its financial position.

2. Cash Flow Statement

One of Motorola Solutions' key strengths is its ability to generate strong free cash flows consistently. During the 2019-2023 period, the company's free cash flow ranged from $1.4 billion to $1.8 billion. Motorola Solutions has been utilizing its cash for share repurchases, dividend payments, and acquisitions, as evidenced by the negative cash flows from financing activities.

The company's cash position has also improved, increasing from $1.0 billion in 2019 to $1.7 billion in 2023, which indicates a healthy liquidity position.

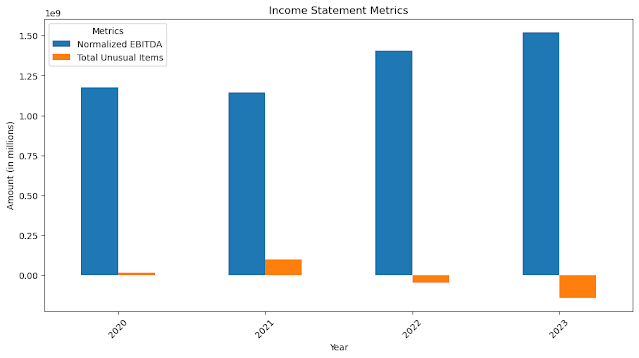

3. Income Statement

Motorola Solutions has experienced steady revenue growth, with total revenue increasing from $7.4 billion in 2019 to $10.0 billion in 2023. This growth reflects strong demand for the company's products and services. Additionally, Motorola Solutions has demonstrated improved cost management and pricing power, as evidenced by the increase in its gross profit margin from 48.7% in 2019 to 49.8% in 2023.

The company's operating income has also grown significantly, from $1.5 billion in 2019 to $2.5 billion in 2023, driven by revenue growth and operational efficiencies. Consequently, net income has increased from $949 million in 2019 to $1.7 billion in 2023, resulting in an improvement in earnings per share (EPS) from $5.45 to $9.93 during the same period.

4. Key Financial Ratios

Motorola Solutions boasts strong profitability ratios, with a profit margin of 13.65%, a return on assets (ROA) of 12.64%, and a return on equity (ROE) of 355.47%. However, the company's valuation ratios, such as the trailing P/E ratio of 46.62 and the forward P/E ratio of 26.66, suggest that the stock may be overvalued compared to the market average. The high price-to-book ratio of 120.59 also indicates a premium valuation.

In terms of growth, Motorola Solutions has demonstrated steady revenue growth of 10% and expects substantial earnings growth in the coming year, with a forward EPS of $14.13. The company's liquidity position appears sufficient, with a current ratio of 1.19. However, the high debt-to-equity ratio of 1,280.45 warrants further investigation.

Conclusion

Motorola Solutions' strong financial performance, consistent revenue growth, and healthy cash generation make it an attractive investment opportunity. The company's focus on public safety and enterprise security solutions positions it well for future growth. However, potential investors should consider the risks associated with the company's reliance on goodwill and intangible assets, its high debt levels, and its premium valuation.

Overall, Motorola Solutions' strong market position, financial stability, and growth prospects make it a compelling investment choice for those seeking exposure to the communication equipment industry. As always, investors should conduct their own thorough research and consider their individual financial goals and risk tolerance before making any investment decisions.

.png)

.png)

.png)