The economic landscape is ever-changing, and one crucial indicator of these shifts is the Consumer Price Index (CPI). Released on December 12, 2023, the latest report provides a comprehensive overview of the monthly and yearly percentage changes in the cost of living for urban consumers in the United States. Let's delve into the key highlights and decipher what these numbers mean for consumers and policymakers alike.

1. All Items: Navigating Inflation

The overall CPI for all items in the U.S. City Average saw a modest monthly increase of 0.1%, contributing to a 3.1% rise compared to the previous year. This suggests a gradual upward trend in the general cost of living, reflecting broader economic shifts.

2. New Vehicles: Bucking the Trend

In contrast, new vehicles experienced a monthly decrease of -0.4%, signaling potential relief for consumers looking to make a significant purchase in the automotive sector. However, the yearly change still showed a positive trend of 1.3%.

3. Shelter: Rising Living Costs

Shelter costs, a critical component of the CPI, rose by 0.4% in the month and a substantial 6.5% over the year. This increase could have significant implications for individuals and families, especially in the housing market.

4. Energy: A Significant Dip

Energy costs took a notable dip, with a monthly change of -2.3% and a yearly change of -5.4%. This decrease, largely attributed to a sharp decline in gasoline prices, could offer relief to consumers but may also have implications for the broader energy sector.

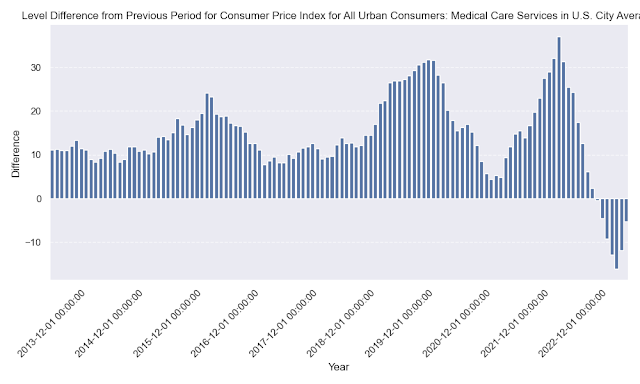

5. Medical Care: Balancing Act

Medical care costs edged up by 0.6% monthly and a marginal 0.2% annually. This suggests a delicate balance in the healthcare sector, with incremental increases in costs.

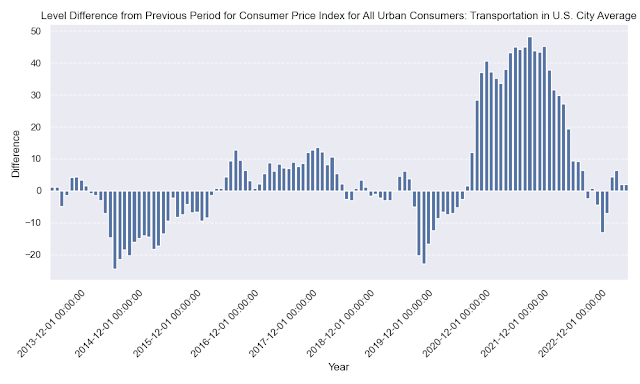

6. Transportation: Navigating Volatility

Transportation costs exhibited a monthly decrease of -0.6%, though the yearly change remained positive at 0.8%. This volatility may be reflective of ongoing challenges in the transportation industry.

7. Housing: Stability Amidst Growth

Housing costs, including rent of primary residence, increased by 0.2% monthly and 5.2% yearly. This stability, combined with growth, points to the resilience of the housing market.

8. Apparel: Fashioning Change

Apparel costs experienced a significant monthly decrease of -1.3%, indicating potential discounts or changes in consumer spending habits within the fashion industry.

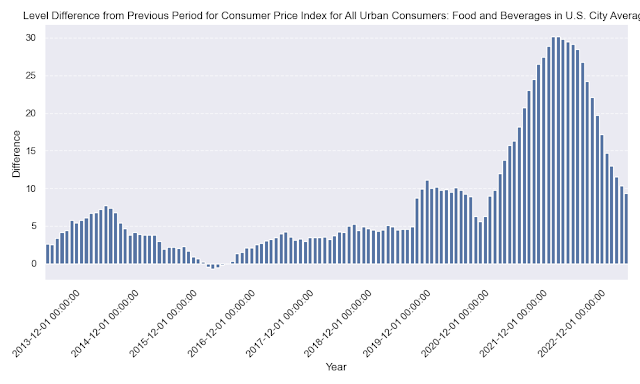

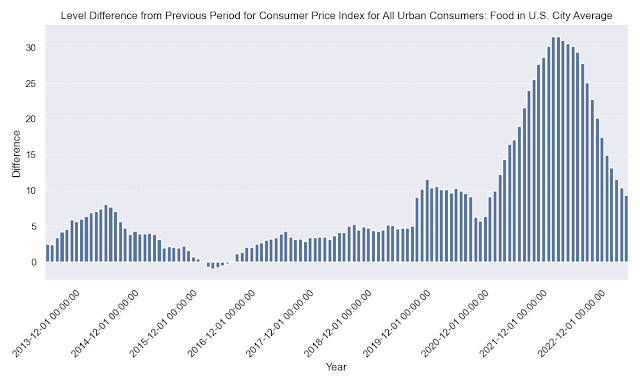

9. Food: Nourishing Inflation

Food costs, both at home and away, rose by 0.1% and 0.4% monthly, respectively. The yearly changes of 1.7% and 5.3% indicate a sustained increase in food-related expenses.

10. Education and Communication: Marginally Down

Education and communication costs showed a marginal decrease of -0.3% monthly and remained relatively stable with a yearly change of -0.1%.

Source: https://www.bls.gov/news.release/cpi.nr0.htm

No comments:

Post a Comment