Introduction

The construction industry is a vital component of the economy, reflecting broader economic trends and influencing growth. The latest data released in November 2023 for construction spending in October offers valuable insights into the current state of the industry. This blog post delves into these figures, highlighting key trends and their implications.

Overview of October 2023 Construction Spending

Total Construction Spending in the United States

- Monthly Change: +0.6%

- Annual Change: +10.7%

October 2023 saw a modest monthly increase in total construction spending, but the annual figure tells a more significant story, with a substantial 10.7% rise. This indicates robust year-over-year growth, signaling strong industry momentum.

Residential vs. Nonresidential Construction

Residential Construction

- Monthly Change: +1.2%

- Annual Change: +0.9%

Residential construction spending increased more significantly on a monthly basis compared to the overall construction spending. However, the annual growth rate is relatively modest. This suggests a steady demand in the housing market but not at an explosive rate.

Nonresidential Construction

- Monthly Change: +0.1%

- Annual Change: +20.0%

Nonresidential construction spending shows a different trend. Despite a smaller monthly increase, the annual change is a striking 20.0%, indicating a significant surge over the past year. This could be attributed to increased investments in commercial, industrial, and public infrastructure projects.

Private vs. Public Construction Spending

Private Construction

- Total Monthly Change: +0.7%

- Total Annual Change: +9.2%

- Residential Monthly Change: +1.2%

- Residential Annual Change: +0.7%

- Nonresidential Monthly Change: +0.1%

- Nonresidential Annual Change: +22.4%

Private construction spending shows healthy growth, particularly in the nonresidential sector. The massive annual increase in nonresidential spending reflects a booming private sector investment in commercial and industrial infrastructure.

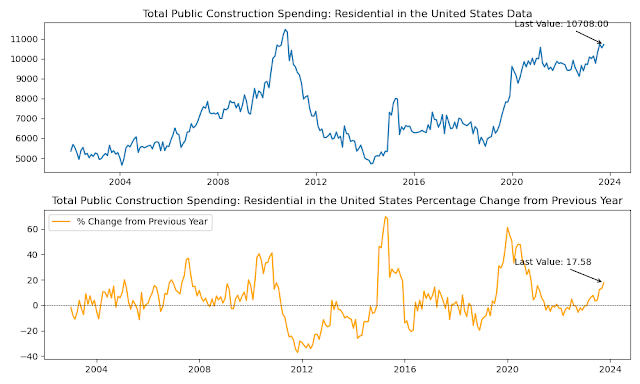

Public Construction

- Total Monthly Change: +0.2%

- Total Annual Change: +16.4%

- Residential Monthly Change: +1.6%

- Residential Annual Change: +17.6%

- Nonresidential Monthly Change: +0.2%

- Nonresidential Annual Change: +16.4%

Public construction spending also shows significant growth, especially in the residential sector. This could be indicative of increased government investment in public housing and infrastructure projects.

Implications and Future Outlook

The October 2023 construction spending data reveals several key trends:

Strong Growth in Nonresidential Sector: Both private and public sectors are heavily investing in nonresidential construction, possibly driven by economic recovery, expansion of businesses, and public infrastructure projects.

Steady Residential Market: The residential construction market is growing, albeit at a slower pace, suggesting a stable housing market.

Economic Indicators: The construction spending trends are positive indicators for the economy, reflecting confidence in business and government sectors.

Looking ahead, these trends are likely to continue, influenced by economic policies, interest rates, and overall economic health. The construction industry, being a significant economic driver, will play a crucial role in shaping the economic landscape in the coming years.

Conclusion

The October 2023 construction spending data provides valuable insights into the current state and trajectory of the construction industry. With significant growth in nonresidential construction and steady increases in residential construction, the industry is poised to continue being a key player in the broader economic narrative. Stakeholders in the construction sector should closely monitor these trends to make informed decisions and capitalize on emerging opportunities.

No comments:

Post a Comment