library(ggplot2)

library(Quandl)

library(zoo)

library(quantmod)

library(TTR)

library(forecast)

library(ggfortify)

library(psych)

library(pastecs)

library(xts)

start <- as.Date("1990-01-01")

getSymbols(c(

'NYXRSA',

'BOXRSA',

'SDXRSA',

'CHXRSA',

'DNXRSA',

'LVXRSA',

'DAXRSA',

'WDXRSA',

'MIXRSA',

'ATXRSA',

'SFXRSA',

'LXXRSA',

'SEXRSA',

'CSUSHPISA'

), from=start, src='FRED')

names(NYXRSA)<-"New York"

names(BOXRSA)<-"Boston"

names(SDXRSA)<-"San Diego"

names(CHXRSA)<-"Chicago"

names(DNXRSA)<-"Denver"

names(LVXRSA)<-"Las Vegas"

names(WDXRSA)<-"DC"

names(MIXRSA)<-"Miami"

names(DAXRSA)<-"Dallas"

names(ATXRSA)<-"Atlanta"

names(SFXRSA)<-"San Francisco"

names(LXXRSA)<-"Los Angeles"

names(SEXRSA)<-"Seattle"

names(CSUSHPISA)<-"National"

Mortgage<-getSymbols('MORTGAGE30US', src='FRED')

Housing_Price=ATXRSA

Compare_Max=Housing_Price/max(Housing_Price)*100

Diff_Housing=Delt(Housing_Price,k=12)*100

Annual_Changes=annualReturn(Housing_Price)*100

par(mfrow=c(2,1))

plot(Diff_Housing)

plot(Annual_Changes)

summary(last(Annual_Changes,'7 years'))

describe(Annual_Changes)

par(mfrow=c(3,1))

plot(ATXRSA, main="ATLANTA")

plot(Delt(ATXRSA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(ATXRSA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

par(mfrow=c(3,1))

plot(BOXRSA, main="BOSTON")

plot(Delt(BOXRSA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(BOXRSA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

par(mfrow=c(3,1))

plot(CHXRSA, main="CHICAGO")

plot(Delt(CHXRSA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(CHXRSA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

par(mfrow=c(3,1))

plot(DAXRSA, main="DALLAS")

plot(Delt(DAXRSA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(DAXRSA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

par(mfrow=c(3,1))

plot(DNXRSA, main="DENVER")

plot(Delt(DNXRSA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(DNXRSA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

par(mfrow=c(3,1))

plot(LVXRSA, main="LAS VEGAS")

plot(Delt(LVXRSA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(LVXRSA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

par(mfrow=c(3,1))

plot(MIXRSA, main="MIAMI")

plot(Delt(MIXRSA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(MIXRSA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

par(mfrow=c(3,1))

plot(NYXRSA, main="NEW YORK")

plot(Delt(NYXRSA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(NYXRSA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

par(mfrow=c(3,1))

plot(SDXRSA, main="SAN DIEGO")

plot(Delt(SDXRSA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(SDXRSA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

par(mfrow=c(3,1))

plot(SEXRSA, main="SEATTLE")

plot(Delt(SEXRSA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(SEXRSA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

par(mfrow=c(3,1))

plot(SFXRSA, main="SAN FRANSICO")

plot(Delt(SFXRSA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(SFXRSA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

par(mfrow=c(3,1))

plot(WDXRSA, main="WASHINGTON DC")

plot(Delt(WDXRSA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(WDXRSA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

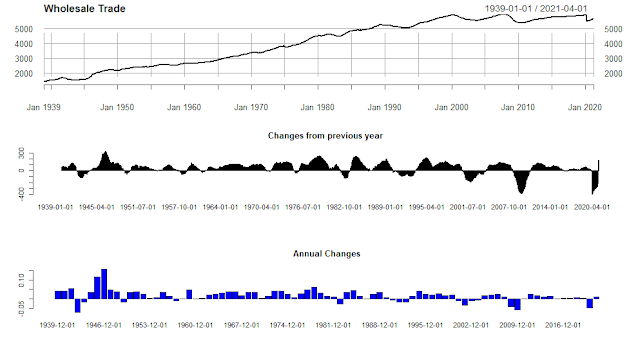

par(mfrow=c(3,1))

plot(CSUSHPISA, main="US NATIONAL")

plot(Delt(CSUSHPISA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(CSUSHPISA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

dev.off()

barplot(Annual_Changes, main=" Annual Changes ", col="blue", cex.names=0.8, las=2)

Monthly_Price<-monthlyReturn(Housing_Price)

Monthly_Rate<-MORTGAGE30US

Housing<-na.omit(merge(Monthly_Price,MORTGAGE30US))

head(Housing)

# Scatter chart for Price chagnes

scatter.smooth(last(Housing, "10 years"))

abline(lm(Housing$monthly.returns~Housing$MORTGAGE30US), col="blue")

# Regressiion Model

alli.mod1=lm(Combined$monthly.returns~Combined$MORTGAGE30US, data=Combined)

summary(alli.mod1)

autoplot(MORTGAGE30US)

y<-(Housing_Price)

library(ggfortify)

library(forecast)

autoplot(y)

d.arima<-auto.arima(y)

d.arima

d.forecast<-forecast(d.arima)

d.forecast

autoplot(forecast(d.arima, 36))

fit<-ets(y)

autoplot(stl(y, plot=FALSE))

ggtsdiag(auto.arima(y))

autoplot(forecast(fit,36))

Housing_Prices <- as.xts(data.frame(

NYXRSA,

BOXRSA,

SDXRSA,

CHXRSA,

DNXRSA,

LVXRSA,

WDXRSA,

MIXRSA,

LXXRSA,

SFXRSA

))

Housing_return = apply(Housing_Prices, 1, function(x) {x / Housing_Prices[1,]}) %>%

t %>% as.xts

head(Housing_return)

Summary_Stat<-summary(Housing_return)

cor(Housing_return)

write.table(Summary_Stat, "Summary.xls")

plot(as.zoo(Housing_return), screens = 1, lty = 1:10, xlab = "Date", ylab = "Home Price Index")

legend("topleft", c("New York", "Boston", "San Diego","Chicago",

"Denver", "Las Vegas","DC",

"Miami", "Los Angeles", "San Francisco"), lty = 1:10, cex = 0.5)

plot(Housing_return, xlab = "Date", ylab = "Index (1987=100)")

legend("right", c("New York", "Boston", "San Diego","Chicago",

"Denver", "Las Vegas","DC",

"Miami","Los Angeles","San Francisco"),

fill=c("blue","red","green","black","sky blue","purple","yellow",

"white", "black","red"

) )

ggplot(Housing_return, aes( x=))

tail(Housing_return)