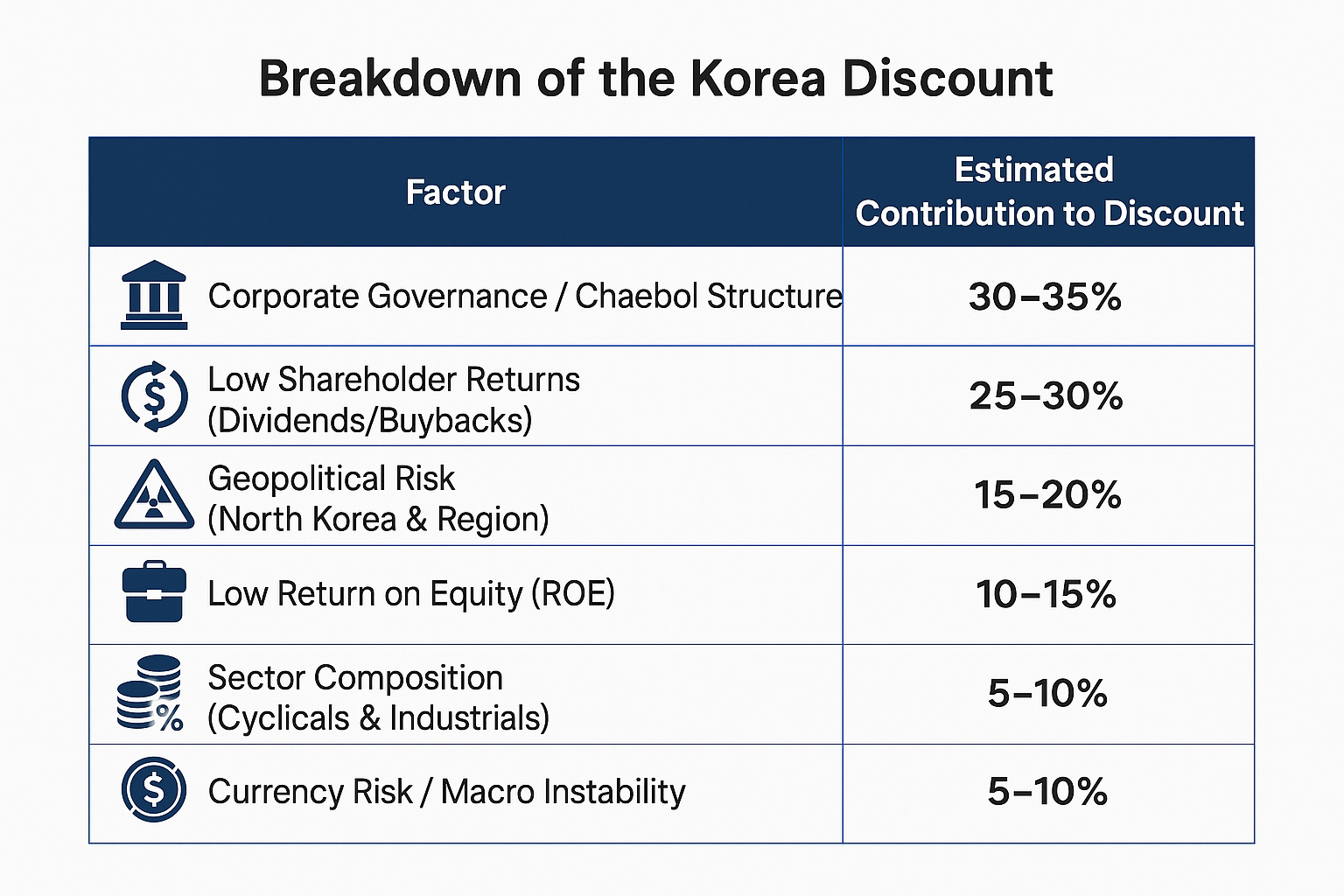

📉 Estimated Breakdown of the Korea Discount

| Factor | Estimated Contribution to Discount | Explanation |

|---|---|---|

| 🏢 Corporate Governance / Chaebol Structure | 30–35% | Opaque ownership, lack of transparency, poor minority shareholder protection, cross-shareholding |

| 💰 Low Shareholder Returns (Dividends/Buybacks) | 25–30% | Historically low dividend payout ratios (~19%), weak incentives for capital return |

| ☢️ Geopolitical Risk (North Korea & Region) | 15–20% | Persistent threat from North Korea and tensions with China discourage foreign investment |

| 💼 Low Return on Equity (ROE) | 10–15% | Many companies trade below book due to low asset profitability |

| 🏭 Sector Composition (Cyclicals & Industrials) | 5–10% | Heavy industries and semiconductors dominate; lower multiples due to cyclicality |

| 💱 Currency Risk / Macro Instability | 5–10% | Foreign investor aversion due to won volatility and capital outflow concerns |

🔍 1. Corporate Governance / Chaebol Structure (~30–35%)

- Dominance of family-owned conglomerates (chaebols) with complex and opaque governance systems.

- Limited protection for minority shareholders.

- Resistance to reforms that weaken control, such as cross-shareholding unwinding.

- Seen as the biggest structural drag on valuation, especially by global institutional investors.

💵 2. Low Shareholder Returns (~25–30%)

- Korea’s dividend payout ratio is the lowest among major economies.

- Share buybacks are rare and often modest.

- Investors view Korean firms as hoarding cash or misallocating capital—thus unwilling to assign high P/E or P/B multiples.

☢️ 3. Geopolitical Risk (~15–20%)

- Proximity to North Korea and regional tensions (e.g., China-U.S. rivalry) create an enduring risk premium.

- Investors require lower entry prices to compensate for security and policy uncertainty.

🧮 4. Low Return on Equity (~10–15%)

- Many firms deliver low earnings relative to their asset bases.

- Contributes directly to sub-1 P/B ratios—the market is reluctant to price equity above book when ROE is weak.

🏭 5. Market Composition (~5–10%)

- Korea’s index is overweight in semiconductors, autos, steel, and shipbuilding—all cyclical sectors.

- These sectors naturally carry lower valuation multiples due to earnings volatility.

💱 6. Currency & Macro Risk (~5–10%)

- Volatility of the Korean won makes foreign investors cautious.

- Korea’s export-heavy economy is highly exposed to global shocks, especially China.

📌 Summary Table (Visual Form)

| Factor | Approx. Weight | Comments |

|---|---|---|

| Corporate Governance | 30–35% | Largest contributor; long-standing structural weakness |

| Shareholder Return Policy | 25–30% | Low payout, low ROE depress investor interest |

| Geopolitical Tension | 15–20% | Risk premium from North Korea, China proximity |

| Return on Equity | 10–15% | Low ROE leads to P/B < 1 |

| Sector Bias (Cyclicals) | 5–10% | Volatile earnings, modest growth |

| Currency Risk / Macro Exposure | 5–10% | Foreign investors avoid won exposure during uncertainty |

📈 Why This Matters

Understanding the components of the Korea Discount helps explain why Korean stocks remain undervalued despite global competitiveness in sectors like semiconductors, batteries, and biotech. It also provides a roadmap for reform:

- Governance reform and shareholder activism could reduce 50–60% of the discount.

- Improving ROE and capital efficiency would raise valuations further.

- Easing geopolitical risks or improving diplomacy would gradually lift the risk premium.

If all these factors were addressed, the P/B ratio could move closer to 1.8–2.2 and P/E toward 14–16, aligning Korea with Taiwan or Japan.

No comments:

Post a Comment