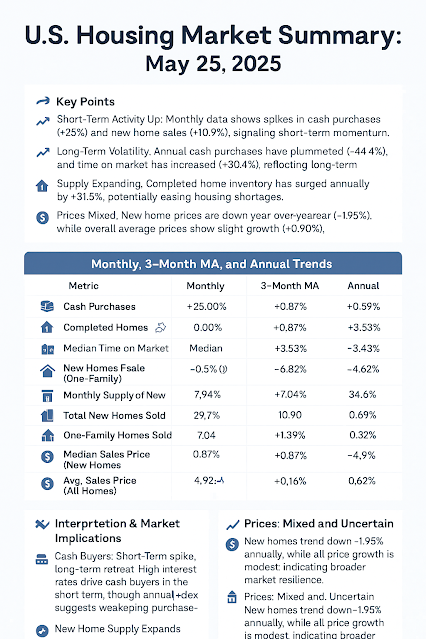

As of May 25, 2025, the U.S. housing market continues to exhibit mixed signals, driven by evolving buyer behavior, shifting inventory levels, and dynamic pricing. Recent data reveals notable contrasts between short-term momentum and long-term uncertainty, offering both opportunities and caution for buyers, sellers, investors, and policymakers.

🔑 Key Trends at a Glance

-

📈 Short-Term Momentum:Cash purchases surged +25% month-over-month, and new one-family home sales increased +10.9%, reflecting temporary demand spikes.

-

🏗️ Supply Expansion:Completed new homes for sale are up +31.5% year-over-year, suggesting progress in addressing housing shortages.

-

🕒 Longer Time on Market:Newly completed homes are taking +30.4% longer to sell than they did a year ago — signaling cooling demand or buyer hesitation.

-

💵 Prices Mixed:New home median prices fell -1.95% annually, while overall average prices rose a modest +0.90%, highlighting diverging trends.

📊 Detailed Market Breakdown

| Metric | Monthly | 3-Month Avg | Annual |

|---|---|---|---|

| Cash Purchases | +25.00% | -11.11% | -44.44% |

| Completed Homes for Sale | 0.00% | +0.87% | +31.46% |

| Time on Market for New Homes | 0.00% | +3.53% | +30.43% |

| Total New Homes for Sale | -0.59% | +0.53% | +8.62% |

| Monthly Supply of New Homes | -10.99% | -3.30% | +5.19% |

| Total New Homes Sold | +7.94% | +6.82% | +4.62% |

| New One-Family Homes Sold | +10.90% | +4.08% | +3.34% |

| Median Sales Price (New Homes) | +0.87% | -1.80% | -1.95% |

| Average Sales Price (All Homes) | -1.39% | +0.11% | +0.90% |

| Median Sales Price (All Homes) | -0.57% | +0.19% | +0.82% |

🧠 Insights and Implications

🔹 For Buyers

-

With new home inventory expanding and prices softening, now may be a favorable time to negotiate.

-

Longer time on market gives buyers added leverage — especially for newly completed homes.

🔹 For Sellers

-

Adjusting pricing expectations and marketing strategies is key as homes sit on the market longer.

-

Sellers should be aware of the decline in cash buyers year-over-year, even if short-term spikes occur.

🔹 For Investors

-

Inventory growth and steady sales offer potential, but price fluctuations and slower turnover require caution.

-

High interest rates may continue to pressure certain segments of the market.

🔹 For Policymakers

-

The volatility in cash buyer behavior and persistent affordability concerns call for balanced housing and lending policies.

-

Continued support for new construction could help ease long-term supply issues.

🔗 Sources