Inflation is a critical economic measure that impacts everyone, influencing the prices of everyday goods and services. To understand inflation better, we can look at the Consumer Price Index (CPI), which tracks changes in prices across a broad range of products. Recent data reveals some interesting trends, with both short-term shifts and longer-term changes offering insights into the state of the economy. Let’s dive into the details.

Annualized Monthly Change: A Snapshot of Recent Trends

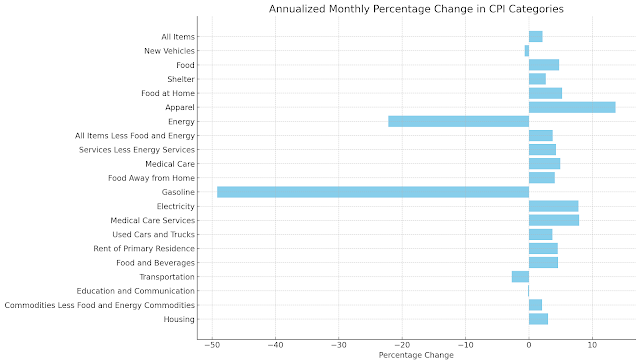

The annualized monthly percentage change gives us a closer look at how prices have shifted recently. Some categories have experienced notable increases, while others have seen sharp declines:

Rising Prices in Apparel and Electricity: The apparel sector saw the largest increase in prices, with a 13.7% jump. This could be due to changes in production costs, supply chain adjustments, or shifts in consumer demand. Similarly, electricity costs rose by about 7.8%, reflecting higher energy costs that directly impact utility bills for households.

Energy Prices See a Steep Decline: On the opposite end, energy prices have significantly decreased, with gasoline prices plummeting by 49.2%. This sharp decline suggests that recent shifts in the global oil market or changes in energy demand have made fuel more affordable, providing some relief at the pump.

Stable Growth in Essentials: Categories like food, medical care, and housing continue to show steady price increases. Food prices, for example, have increased by 4.8%, while shelter costs rose by 2.7%. These changes indicate ongoing pressure on household budgets, particularly for those facing rising costs in essential categories.

Year-over-Year Change: The Bigger Picture

Looking at the year-over-year percentage change allows us to see how prices have evolved over a longer period, offering insights into broader inflation trends:

Energy's Long-Term Adjustment: The energy sector has experienced a year-over-year decrease, with gasoline prices down by 15.3%. Although this decline is not as steep as the recent monthly changes, it reflects a longer-term adjustment in fuel costs, possibly tied to shifts in global supply and demand dynamics.

Persistent Increases in Shelter and Housing: The costs of shelter and housing, including rent, continue to climb, with shelter up 4.8% and rent rising by 4.8% as well. These increases highlight ongoing challenges in the housing market, where limited supply and high demand keep prices elevated. For many, housing remains a significant contributor to their overall cost of living.

Moderate Increases in Services: Medical care and food away from home show year-over-year increases, up by 3.3% and 3.9%, respectively. This indicates that services, especially those related to healthcare and dining, continue to experience price pressures, reflecting factors like labor costs and supply constraints.

Key Takeaways: What This Means for Consumers

The CPI data paints a complex picture of inflation. While energy prices have recently fallen, offering some short-term relief, other categories like shelter and food continue to exert upward pressure. This means that while some bills, like those at the gas station, might be lower than before, other costs, such as rent and groceries, remain a challenge.

Understanding these trends helps us see the broader economic context. For policymakers, this data is crucial in shaping decisions about interest rates and economic support measures. For consumers, it offers a way to plan and adjust budgets according to shifting price pressures.

Looking Ahead: What to Watch

As we move forward, a few factors will be key in determining the direction of inflation:

Energy Markets: The future of energy prices, especially with global geopolitical uncertainties, will be pivotal in shaping overall inflation. Continued declines in fuel prices could ease some inflationary pressures.

Housing Market Dynamics: The persistent rise in shelter costs suggests that affordability remains a significant issue in the housing market. Watching for any changes in housing supply, interest rates, and construction activity will be important.

Consumer Spending Patterns: Shifts in consumer spending, especially in discretionary categories like apparel, could influence how inflation evolves. If consumers pull back on spending, it could slow price increases in non-essential areas.

Conclusion

Inflation is not a one-size-fits-all story. It varies significantly across different sectors, and recent CPI data shows that while energy prices have taken a dive, essentials like shelter and food continue to weigh on household budgets. By staying informed about these trends, we can better navigate the changing economic landscape and make informed decisions for our financial futures.

Understanding the CPI and its implications can empower us to manage our expenses and anticipate changes in the broader economy. As we watch these trends unfold, it’s clear that the story of inflation is far from over—it's evolving, reflecting the complex interplay between global markets and everyday life.

No comments:

Post a Comment