Amgen Inc. (AMGN) is a leading biotechnology company that has demonstrated strong financial performance over the past few years. In this blog post, we will delve into Amgen's financial statements, key metrics, and valuation to provide a comprehensive analysis of the company's current position and future prospects.

Financial Performance:

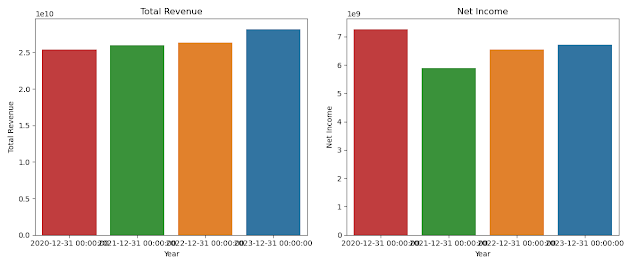

Amgen's revenue has grown steadily from $25.4 billion in 2020 to $28.2 billion in 2023, representing a 10.8% increase over three years. The company's impressive revenue growth of 22% ranks in the 95th percentile among its peers, highlighting its strong market position. Amgen has maintained healthy operating margins ranging from 33% to 36%, and its gross margin of 70.4% ranks in the 80th percentile, indicating robust profitability.

The company's net income has remained stable, fluctuating between $5.9 billion and $7.3 billion over the past four years. Amgen's EPS of 7 ranks in the 62nd percentile, suggesting a solid earnings performance compared to its peers. Free cash flow generation has been consistently strong, exceeding $7 billion annually, although it ranks in the 36th percentile compared to other companies.

Valuation:

Amgen's stock trades at premium valuation multiples compared to its peers. The company's P/E ratio of 44.47 and P/B ratio of 33.23 rank in the 84th and 91st percentiles, respectively. This indicates that investors are willing to pay a higher price for Amgen's stock, reflecting their confidence in the company's growth prospects and financial stability. Additionally, Amgen offers a dividend yield of 2.89%, which is slightly above average and ranks in the 59th percentile.

Balance Sheet and Leverage:

One area of concern for Amgen is its increasing leverage. The company's net debt has risen from $26.7 billion in 2020 to $53.7 billion in 2023, primarily due to significant spending on acquisitions. Amgen's debt-to-equity ratio of 1274.79 is exceptionally high, placing it in the 95th percentile among its peers. This high level of debt may raise eyebrows among investors and warrants close monitoring.

Furthermore, goodwill and intangibles constitute a substantial portion of Amgen's total assets, accounting for $51.3 billion or 53% of the total. This significant amount of intangible assets may expose the company to potential impairment risks in the future.

Profitability and Cash Flow:

Despite the increased leverage, Amgen showcases strong profitability metrics. The company's return on equity (ROE) of 72.58% ranks in the 91st percentile, indicating its efficiency in generating returns for shareholders. However, operating cash flows have declined from $10.5 billion in 2020 to $8.5 billion in 2023, although they remain at healthy levels.

Conclusion:

Amgen Inc. (AMGN) exhibits strong financial performance, with steady revenue growth, stable net income, and robust profitability margins. The company's premium valuation multiples reflect investor confidence in its future prospects. However, investors should keep a close eye on Amgen's increasing leverage and high debt-to-equity ratio, as well as the significant amount of goodwill and intangibles on its balance sheet.

Despite these concerns, Amgen's strong market position, solid earnings performance, and healthy free cash flow generation make it an attractive investment opportunity for those who believe in the company's ability to manage its debt and continue its growth trajectory. As always, investors should conduct their own thorough research and consider their individual investment goals and risk tolerance before making any investment decisions.

No comments:

Post a Comment