Financial Markets

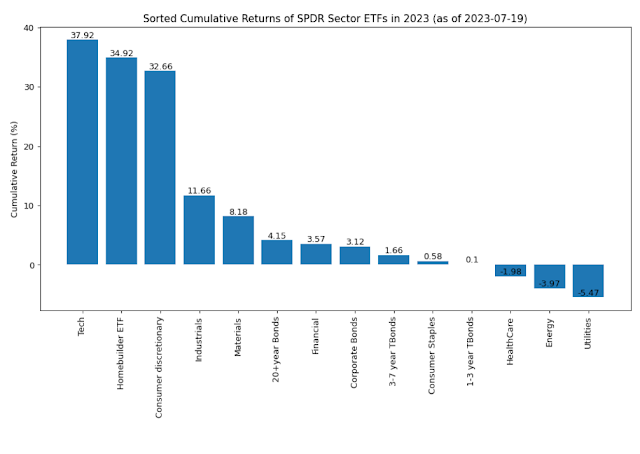

The financial markets have been volatile in recent months, with some sectors performing better than others. Three sectors that have exhibited positive returns are Tech, Homebuilders, and Consumer Discretionary ETFs. These sectors have been driven by a number of factors, including technological advancements, strong consumer demand, and regulatory changes.

Tech Sector

The Tech sector has been one of the best-performing sectors in the financial markets in recent years. This is due to a number of factors, including the continued growth of the digital economy, the rise of cloud computing, and the increasing demand for mobile devices. Tech stocks have also benefited from strong investor confidence, which has helped to drive up their prices.

Homebuilders Sector

The Homebuilders sector has also performed well in recent months, as the housing market has continued to recover. This is due to a number of factors, including low interest rates, strong demand for housing, and an improving economy. Homebuilder stocks have also benefited from the fact that they are relatively defensive stocks, meaning that they tend to perform well even in times of economic uncertainty.

Consumer Discretionary Sector

The Consumer Discretionary sector includes stocks of companies that sell non-essential goods and services, such as retailers, restaurants, and travel companies. This sector has also performed well in recent months, as consumers have been spending more money on discretionary items. This is due to a number of factors, including strong employment growth, rising wages, and tax cuts.

Energy and Utilities Sectors

In contrast to the Tech, Homebuilders, and Consumer Discretionary sectors, the Energy and Utilities sectors have exhibited negative returns in recent months. This is due to a number of factors, including falling oil prices, regulatory changes, and shifting consumer preferences.

Oil Prices

The price of oil has fallen sharply in recent months, due to a number of factors, including the global economic slowdown and the rise of renewable energy sources. This has had a negative impact on the Energy sector, as many energy companies rely on oil and gas production for their profits.

Regulatory Changes

The Utilities sector has also been affected by regulatory changes. In recent years, governments around the world have been increasing regulation of the utilities industry, in an effort to reduce greenhouse gas emissions and promote renewable energy. This has led to higher costs for utilities companies, which has had a negative impact on their profits.

Consumer Preferences

Finally, the Utilities sector has also been affected by shifting consumer preferences. In recent years, consumers have been increasingly turning to alternative energy sources, such as solar and wind power. This has led to a decline in demand for traditional utilities services, such as electricity and natural gas.

Conclusion

The financial markets have been volatile in recent months, with some sectors performing better than others. The Tech, Homebuilders, and Consumer Discretionary sectors have all exhibited positive returns, while the Energy and Utilities sectors have experienced negative returns. These divergent performances reflect the varying dynamics and factors influencing different sectors.

No comments:

Post a Comment