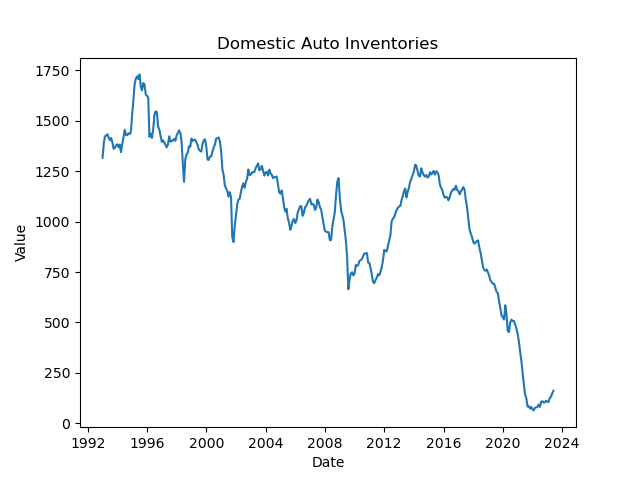

The US car market in 2023 has still not recovered to pre-pandemic levels. In 2022, the US car market increased by 11% year-on-year, but did not reach the 2019 level. The US car market is expected to grow by 5% year-on-year in 2023, but it is difficult to recover to the 2019 level.

My objective is to simplify and clarify economics, making it accessible to everyone. It is important to remember that the opinions expressed in my writing are solely my own and should not be considered as financial advice. Any potential losses incurred from acting upon the information provided in my writing are the responsibility of the individual, and I cannot be held liable for them.

Translate

Friday, July 28, 2023

Semiconductors Stocks as of 2023-07-28

| NVDA | NVIDIA Corporation |

| TSM | Taiwan Semiconductor Manufacturing Co., Ltd. Sponsored ADR |

| AVGO | Broadcom Inc. |

| TXN | Texas Instruments Incorporated |

| ASML | ASML Holding NV ADR |

| INTC | Intel Corporation |

| QCOM | QUALCOMM Incorporated |

| ADI | Analog Devices, Inc. |

| AMD | Advanced Micro Devices, Inc. |

| LRCX | Lam Research Corporation |

| AMAT | Applied Materials, Inc. |

| SNPS | Synopsys, Inc. |

| MU | Micron Technology, Inc. |

| CDNS | Cadence Design Systems, Inc. |

| KLAC | KLA Corporation |

Thursday, July 27, 2023

Gross Domestic Product, Second Quarter 2023 (Advance Estimate)

- Real gross domestic product (GDP) increased at an annual rate of 2.4% in the second quarter of 2023, following an increase of 2.0% in the first quarter.

- The increase in GDP was led by increases in consumer spending, nonresidential fixed investment, state and local government spending, private inventory investment, and federal government spending.

- Imports decreased, which helped to offset some of the growth in domestic spending.

- The price index for gross domestic purchases increased 1.9% in the second quarter, compared with an increase of 3.8% in the first quarter.

- Personal income increased $236.1 billion in the second quarter, compared with an increase of $278.0 billion in the first quarter.

- Disposable personal income increased $248.2 billion, or 5.2%, in the second quarter, compared with an increase of $587.9 billion, or 12.9%, in the first quarter.

- Real disposable personal income increased 2.5% in the second quarter, compared with an increase of 8.5%.

- Personal saving was $869.5 billion in the second quarter, compared with $840.9 billion in the first quarter.

- The personal saving rate—personal saving as a percentage of disposable personal income—was 4.4% in the second quarter, compared with 4.3% in the first quarter.

Overall, the economy grew at a moderate pace in the second quarter of 2023. The increase in GDP was broad-based, with all major spending categories contributing to the growth. However, inflation continued to rise, which could pose a challenge to economic growth in the future.

Source:Gross Domestic Product, Second Quarter 2023 (Advance Estimate) | U.S. Bureau of Economic Analysis (BEA)

Monday, July 24, 2023

The U.S. Stock Markets as of 07-21-2023

As you can see, the U.S. stock markets have recovered this year, but they are still below their peaks. This is likely due to a number of factors, including rising interest rates, inflation, and the ongoing war in Ukraine.

Thursday, July 20, 2023

Currencies Analysis as of 2023-07-20

The value of the U.S. dollar has been strengthening against other currencies in recent months, due to a number of factors, including the Federal Reserve's aggressive interest rate hikes in an effort to combat inflation. This has made U.S. goods and services more expensive for foreign buyers, and has led to a decrease in the value of other currencies against the dollar.

In the case of South Africa, Japan, and China, the decline in their currency values is likely due to a combination of factors, including the ongoing COVID-19 pandemic, the war in Ukraine, and concerns about global economic growth. These factors have led to investor uncertainty and a decline in demand for these countries' currencies.

In contrast, Mexico and Brazil have seen an increase in their currency values against the dollar. This is likely due to a number of factors, including strong economic growth in these countries, and the fact that they are both major exporters of commodities, which have benefited from rising prices in recent months.

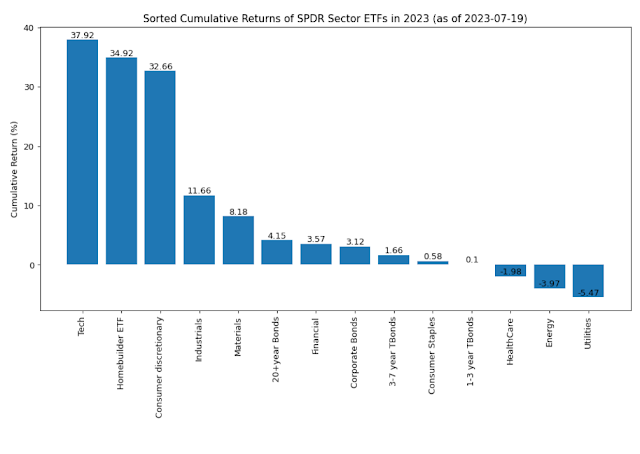

SPDR Sector ETF in as of 2023-07-19

Financial Markets

The financial markets have been volatile in recent months, with some sectors performing better than others. Three sectors that have exhibited positive returns are Tech, Homebuilders, and Consumer Discretionary ETFs. These sectors have been driven by a number of factors, including technological advancements, strong consumer demand, and regulatory changes.

Tech Sector

The Tech sector has been one of the best-performing sectors in the financial markets in recent years. This is due to a number of factors, including the continued growth of the digital economy, the rise of cloud computing, and the increasing demand for mobile devices. Tech stocks have also benefited from strong investor confidence, which has helped to drive up their prices.

Homebuilders Sector

The Homebuilders sector has also performed well in recent months, as the housing market has continued to recover. This is due to a number of factors, including low interest rates, strong demand for housing, and an improving economy. Homebuilder stocks have also benefited from the fact that they are relatively defensive stocks, meaning that they tend to perform well even in times of economic uncertainty.

Consumer Discretionary Sector

The Consumer Discretionary sector includes stocks of companies that sell non-essential goods and services, such as retailers, restaurants, and travel companies. This sector has also performed well in recent months, as consumers have been spending more money on discretionary items. This is due to a number of factors, including strong employment growth, rising wages, and tax cuts.

Energy and Utilities Sectors

In contrast to the Tech, Homebuilders, and Consumer Discretionary sectors, the Energy and Utilities sectors have exhibited negative returns in recent months. This is due to a number of factors, including falling oil prices, regulatory changes, and shifting consumer preferences.

Oil Prices

The price of oil has fallen sharply in recent months, due to a number of factors, including the global economic slowdown and the rise of renewable energy sources. This has had a negative impact on the Energy sector, as many energy companies rely on oil and gas production for their profits.

Regulatory Changes

The Utilities sector has also been affected by regulatory changes. In recent years, governments around the world have been increasing regulation of the utilities industry, in an effort to reduce greenhouse gas emissions and promote renewable energy. This has led to higher costs for utilities companies, which has had a negative impact on their profits.

Consumer Preferences

Finally, the Utilities sector has also been affected by shifting consumer preferences. In recent years, consumers have been increasingly turning to alternative energy sources, such as solar and wind power. This has led to a decline in demand for traditional utilities services, such as electricity and natural gas.

Conclusion

The financial markets have been volatile in recent months, with some sectors performing better than others. The Tech, Homebuilders, and Consumer Discretionary sectors have all exhibited positive returns, while the Energy and Utilities sectors have experienced negative returns. These divergent performances reflect the varying dynamics and factors influencing different sectors.

Cumulative Returns of iShares ETF as of 2023-07-19

Investors are eagerly placing their bets on five countries that are at the forefront of the semiconductor industry in the field of artificial intelligence (AI). These countries include Taiwan, the United States, Korea, Germany, and Japan. With their cutting-edge technologies and innovative approaches, these nations have emerged as the top contenders in this rapidly evolving sector.

Taiwan, renowned for its advanced manufacturing capabilities and robust supply chain, has become a hub for semiconductor production. Its expertise in AI-driven chipsets has garnered significant attention from investors seeking to capitalize on the growing demand for AI-powered devices.

The United States, home to some of the world's leading tech giants, boasts a thriving semiconductor industry. With its strong research and development ecosystem, the US continues to push the boundaries of AI technology, attracting investors who recognize the immense potential for growth and profitability.

Korea, known for its technological prowess, has established itself as a major player in the semiconductor market. The country's semiconductor companies have been instrumental in developing cutting-edge AI chips, making Korea an attractive investment destination for those seeking to ride the wave of AI innovation.

Germany, renowned for its engineering excellence, has made significant strides in the semiconductor industry. The country's focus on precision manufacturing and high-quality standards has positioned it as a key player in the AI semiconductor market. Investors are drawn to Germany's commitment to technological advancement and its ability to deliver state-of-the-art AI solutions.

Japan, a global leader in technology, has a long-standing reputation for innovation in the semiconductor industry. With its strong research and development capabilities, Japan continues to drive advancements in AI chipsets. Investors recognize the country's potential for groundbreaking discoveries and are keen to invest in its semiconductor sector.

Meanwhile, it appears that China and Hong Kong stocks are currently experiencing a downturn. While these markets have shown resilience in the past, investors are currently favoring the aforementioned countries due to their strong foothold in the AI semiconductor industry.

For investors seeking to capitalize on the promising future of AI-driven semiconductors, these five countries present compelling opportunities. By strategically investing in these markets, investors can position themselves at the forefront of the AI revolution and reap the rewards of this rapidly expanding industry.

Monday, July 17, 2023

Sunday, July 16, 2023

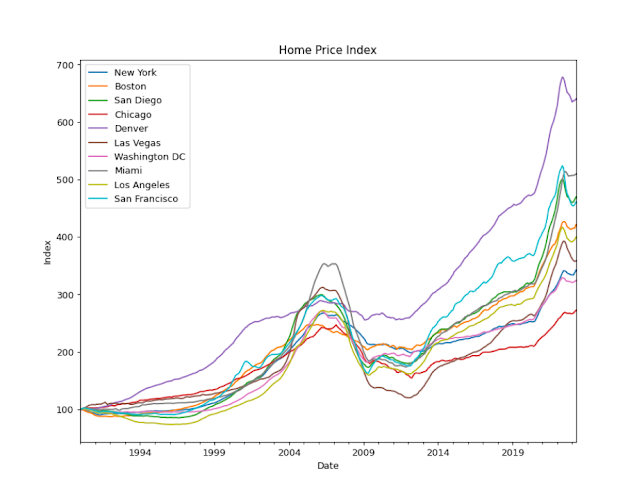

The S&P CoreLogic Case-Shiller Home Price Indices as of April 2023

The following charts depict the annual changes from the previous year in the Case-Shiller Price Index for major U.S. cities, as of April 2023. The analysis reveals that the housing prices at the national level experienced a slight decline of -0.28% compared to the previous year.

Notably, several cities on the West Coast witnessed a decline in housing prices. Specifically, Seattle saw a significant drop of -12.53%, while San Francisco experienced a decline of -11.22% from the previous year. Conversely, cities on the East Coast continue to witness an upward trend in housing prices.