My objective is to simplify and clarify economics, making it accessible to everyone. It is important to remember that the opinions expressed in my writing are solely my own and should not be considered as financial advice. Any potential losses incurred from acting upon the information provided in my writing are the responsibility of the individual, and I cannot be held liable for them.

Translate

Friday, April 21, 2023

Assets and Liabilities of Commercial Banks in the United States - H.8 as of March 2023

The Federal Reserve's statistical release "H.8 - Assets and Liabilities of Commercial Banks in the United States", which provides data on the assets and liabilities of commercial banks in the US. The release provides data on a weekly basis, and includes information such as total assets and liabilities, loans and leases, and deposits. The data is broken down into various categories, such as type of loan, size of deposit, and type of security. The release is important for understanding trends in the banking industry and can be used by policymakers and researchers to monitor the health of the financial system.

The report on the Assets and Liabilities of Commercial Banks in the United States for March 2023 shows a positive trend with a 6.5% increase in total assets and a 3.1% increase in total liabilities. Among the assets, loans to commercial banks saw a significant surge of 345.5%. However, treasury and agency securities experienced a dip of 24.1% in March. On the liabilities side, borrowing showed a substantial rise of 249.8%, whereas other deposits witnessed a decrease of 28.3%. These figures highlight the dynamic nature of the banking sector and provide valuable insights into the trends that are shaping it.

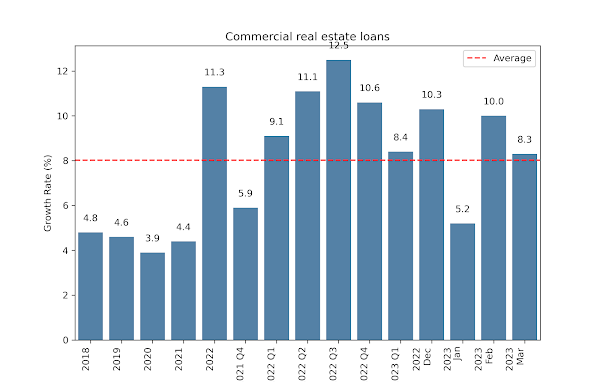

According to the latest report on the Assets and Liabilities of Commercial Banks in the United States - H.8, as of March 2023, real estate loans, including residential and commercial ones, experienced an increase, although the overall trend has been declining since the second quarter of 2022."

Percent change at break adjusted, seasonally adjusted, annual rate.

Source: https://www.federalreserve.gov/releases/h8/current/default.htm

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment