My objective is to simplify and clarify economics, making it accessible to everyone. It is important to remember that the opinions expressed in my writing are solely my own and should not be considered as financial advice. Any potential losses incurred from acting upon the information provided in my writing are the responsibility of the individual, and I cannot be held liable for them.

Translate

Sunday, December 12, 2021

Saturday, November 20, 2021

Analyzing Consumer Price Index (CPI) as of 10-01-2021

library(Quandl)

library(ggplot2)

library(tseries);library(timeseries);library(xts);library(forecast)

library (quantmod)

library(psych)

library(plotly) #install.package(plotly)

#Food and Beverages (CPIFABSL)

#Housing (CPIHOSNS)

#Apparel (CPIAPPSL)

#Transportation (CPITRNSL)

#Medical Care (CPIMEDSL)

#Recreation (CPIRECSL)

#Education and Communication (CPIEDUSL)

# Other Goods and Services (CPIOGSSL)

#Commodities (CUSR0000SAC)

# Services (CUSR0000SAS)

start <- as.Date("1990-01-01")

getSymbols(c('CPIFABSL','CPIHOSNS','CPIAPPSL','CPITRNSL','CPIMEDSL','CPIRECSL',

'CPIEDUSL','CPIOGSSL','CUSR0000SAC','CUSR0000SAS',"CPIAUCSL","CPILFESL"), from=start, src='FRED')

CPI<-merge (CPIFABSL,CPIHOSNS,CPIAPPSL,CPITRNSL,CPIMEDSL,CPIRECSL,

CPIEDUSL,CPIOGSSL,CUSR0000SAC,CUSR0000SAS,CPIAUCSL,CPILFESL)

Diff_CPI <- (CPI/lag(CPI)-1)*100

Diff_CPI[1,] <- 0

Diff_CPIAUCSL=Delt(CPIAUCSL,k=12)*100

Diff_CPIFESL=Delt(CPILFESL,k=12)*100

Diff_CPIFABSL=Delt(CPI$CPIFABSL,k=12)*100

Diff_CPIHOSNS=Delt(CPI$CPIHOSNS,k=12)*100

Diff_CPIAPPSL=Delt(CPI$CPIAPPSL,k=12)*100

Diff_CPITRNSL=Delt(CPI$CPITRNSL,k=12)*100

Diff_CPIMEDSL=Delt(CPI$CPIMEDSL,k=12)*100

Diff_CPIRECSL=Delt(CPI$CPIRECSL,k=12)*100

Diff_CPIEDUSL=Delt(CPI$CPIEDUSL,k=12)*100

Diff_CPIOGSSL=Delt(CPI$CPIOGSSL,k=12)*100

Diff_CUSR0000SAC=Delt(CPI$CUSR0000SAC,k=12)*100

Diff_CUSR0000SAS=Delt(CPI$CUSR0000SAS,k=12)*100

Diff_12<-merge(Diff_CPIFABSL, Diff_CPIHOSNS, Diff_CPIAPPSL, Diff_CPITRNSL,

Diff_CPIMEDSL, Diff_CPIRECSL, Diff_CPIEDUSL, Diff_CPIOGSSL,

Diff_CUSR0000SAC, Diff_CUSR0000SAS)

Diff_12=window(Diff_12,start=as.Date("2001-01-01"), end=as.Date("2021-12-31"))

cor.distance <- cor(Diff_12)

corrplot::corrplot(cor.distance)

plot(Diff_CPIAPPSL)

plot(Diff_12)

plot(Diff_CPIAUCSL, main='Changes from previous year -CPI for All',las=2, subset='2000-01-01/')

plot(Diff_CPIFESL, main='Changes from previous year - Core CPI',las=2,subset='2000-01-01/')

plot(Diff_CPIFABSL, main='Changes from previous year -Food and Beverage',las=2, subset='2000-01-01/')

plot(Diff_CPIHOSNS, main='Changes from previous year -Housing',las=2,subset='2000-01-01/')

plot(Diff_CPIAPPSL, main='Changes from previous year -APPAREL', las=2,subset='2000-01-01/')

plot(Diff_CPITRNSL, main='Changes from previous year -Transportation',las=2,subset='2000-01-01/')

plot(Diff_CPIMEDSL, main='Changes from previous year -Medical Care',las=2,subset='2000-01-01/')

plot(Diff_CPIRECSL, main='Changes from previous year -Recreation',las=2,subset='2000-01-01/')

plot(Diff_CPIEDUSL, main='Changes from previous year -Education and Communication',las=2,subset='2000-01-01/')

plot(Diff_CPIOGSSL, main='Changes from previous year -Other Goods and Services',las=2,subset='2000-01-01/')

plot(Diff_CUSR0000SAC, main='Changes from previous year -Commodities',las=2,subset='2000-01-01/')

plot(Diff_CUSR0000SAS, main='Changes from previous year -Services',las=2,subset='2000-01-01/')

plot(Diff_CPIFABSL)

hist(Diff_CPIFABSL,col='blue')

CPI_2021=window(Diff_CPI,start=as.Date("2021-01-01"), end=as.Date("2021-12-31"))

tail(CPI_2018)

CPI_2021

barplot(CPI_2021$CPIFABSL,las=2)

Sunday, August 29, 2021

Analyzing REITs - Self Storage as of 8/26/2021

require(IKTrading)

require(quantmod)

require(PerformanceAnalytics)

options("getSymbols.warning4.0"=FALSE)

symbols <- c("NSA", #National Storage

"EXR", #Extra Space Storage

"PSA", # Public Storage

"SELF", #Global Self Storage

"CUBE", #Cube Smart

"LSI" #Life Storage

)

from="2003-01-01"

#Home ETFs first, iShares ETFs afterwards

if(!"XLB" %in% ls()) {

suppressMessages(getSymbols(symbols, from="2003-01-01", src="yahoo", adjust=TRUE))

}

Self <- list()

for(i in 1:length(symbols)) {

Self[[i]] <- Cl(get(symbols[i]))

}

Self <- do.call(cbind, Self)

colnames(Self) <- gsub("\\.[A-z]*", "", colnames(Self))

cor(Self)

Storage<-Self/lag(Self)-1

Storage[1,] <- 0

write.table(Storage, file='Storage.xls')

tail(Storage)

Home_2020=window(Storage,start=as.Date("2020-01-01"), end=as.Date("2020-12-31"))

Home_2021=window(Storage,start=as.Date("2021-01-01"), end=as.Date("2021-12-31"))

charts.PerformanceSummary(Home_2021,main='Self Storage REITs Sectors',wealth.index = TRUE)

#calculate the Sharpe ratio

# Sharpe ratio = ((Expected_Return - Risk Free Return) / SD)

Home_Returns<-table.AnnualizedReturns(Home_2021, scale=252, Rf=0.005/252)

Home_Returns

Cumm_Returns=Return.cumulative(Home_2021)*100

Cumm_Returns

chart.CumReturns(Home_2021, main='Home for 2021', begin=c("first", "axis"))

barplot(Cumm_Returns, main='Cummulative Returns for Self REITs')

barplot(Cumm_Returns)

write.csv(Home_Returns, file='return.xls')

cor.distance <- cor(Storage)

corrplot::corrplot(cor.distance)

write.table(cor.distance, file='correlation matrix.xls')

library(igraph)

g1 <- graph.adjacency(cor.distance, weighted = T, mode = "undirected", add.colnames = "label")

mst <- minimum.spanning.tree(g1)

plot(mst)

library(visNetwork)

mst_df <- get.data.frame( mst, what = "both" )

visNetwork(

data.frame(

id = 1:nrow(mst_df$vertices)

,label = mst_df$vertices

)

, mst_df$edges

) %>%

visOptions( highlightNearest = TRUE)

Monday, August 2, 2021

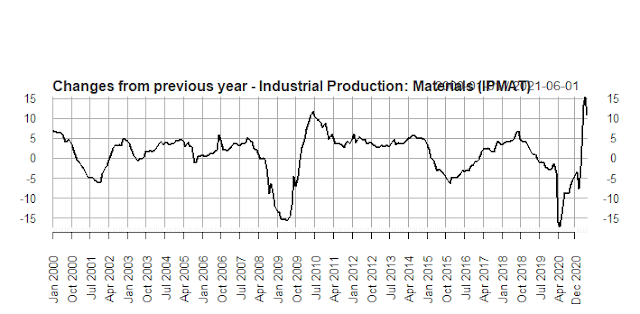

Industrial Production as of 06/2021

Industrial Production as of 06/2021

library(Quandl)

library(ggplot2)

library(tseries);library(timeseries);library(xts);library(forecast)

library (quantmod)

library(psych)

library(plotly) #install.package(plotly)

#Industrial Production (INDPRO)

#Industrial Production: Consumer Goods (IPCONGD)

#Industrial Production: Durable Consumer Goods (IPDCONGD)

#Industrial Production: Non-Durable Consumer Goods (IPNCONGD)

#Industrial Production: Equipment: Business Equipment (IPBUSEQ)

#Industrial Production: Materials (IPMAT)

#Industrial Production: Manufacturing (SIC) (IPMANSICS)

#Industrial Production: Durable Manufacturing (NAICS) (IPDMAN)

#Industrial Production: Non-Durable Manufacturing (NAICS) (IPNMAN)

start <- as.Date("1990-01-01")

getSymbols(c('INDPRO','IPCONGD','IPDCONGD','IPNCONGD','IPBUSEQ','IPMAT',

'IPMANSICS','IPDMAN','IPNMAN'

), from=start, src='FRED')

IND<-merge (INDPRO,IPCONGD,IPDCONGD,IPNCONGD,IPBUSEQ,IPMAT,

IPMANSICS,IPDMAN,IPNMAN)

Diff_IND <- (IND/lag(IND)-1)*100

Diff_IND[1,] <- 0

Diff_INDPRO=Delt(INDPRO,k=12)*100

plot(Diff_INDPRO, main='Changes from previous year - Industrial Production',las=2, subset='2000-01-01/')

Diff_IPCONGD=Delt(IPCONGD,k=12)*100

plot(Diff_IPCONGD, main='Changes from previous year - Industrial Production: Consumer Goods (IPCONGD)',las=2, subset='2000-01-01/')

Diff_IPDCONGD=Delt(IPDCONGD,k=12)*100

plot(Diff_IPDCONGD, main='Changes from previous year - Industrial Production: Durable Consumer Goods (IPDCONGD)',las=2, subset='2000-01-01/')

Diff_IPNcONGD=Delt(IPNCONGD,k=12)*100

plot(Diff_IPNCONGD, main='Changes from previous year - Industrial Production: Non-Durable Consumer Goods',las=2, subset='2000-01-01/')

Diff_IPBUSEQ=Delt(IPBUSEQ,k=12)*100

plot(Diff_IPBUSEQ, main='Changes from previous year - Industrial Production: Equipment: Business Equipment (IPBUSEQ)',las=2, subset='2000-01-01/')

Diff_IPMAT=Delt(IPMAT,k=12)*100

plot(Diff_IPMAT, main='Changes from previous year - Industrial Production: Materials (IPMAT)',las=2, subset='2000-01-01/')

Diff_IPMANSICS=Delt(IPMANSICS,k=12)*100

plot(Diff_IPMANSICS, main='Changes from previous year - Industrial Production: Manufacturing (SIC) (IPMANSICS)',las=2, subset='2000-01-01/')

Diff_IPDMAN=Delt(IPDMAN,k=12)*100

plot(Diff_IPDMAN, main='Changes from previous year - Industrial Production: Durable Manufacturing (NAICS) (IPDMAN)',las=2, subset='2000-01-01/')

Diff_IPNMAN=Delt(IPNMAN,k=12)*100

plot(Diff_IPNMAN, main='Changes from previous year -Industrial Production: Non-Durable Manufacturing (NAICS) (IPNMAN)',las=2, subset='2000-01-01/')

Thursday, May 13, 2021

S&P/ Case-Shiller U.S. City Price Index as of 02-2021

library(ggplot2)

library(Quandl)

library(zoo)

library(quantmod)

library(TTR)

library(forecast)

library(ggfortify)

library(psych)

library(pastecs)

library(xts)

start <- as.Date("1990-01-01")

getSymbols(c(

'NYXRSA',

'BOXRSA',

'SDXRSA',

'CHXRSA',

'DNXRSA',

'LVXRSA',

'DAXRSA',

'WDXRSA',

'MIXRSA',

'ATXRSA',

'SFXRSA',

'LXXRSA',

'SEXRSA',

'CSUSHPISA'

), from=start, src='FRED')

names(NYXRSA)<-"New York"

names(BOXRSA)<-"Boston"

names(SDXRSA)<-"San Diego"

names(CHXRSA)<-"Chicago"

names(DNXRSA)<-"Denver"

names(LVXRSA)<-"Las Vegas"

names(WDXRSA)<-"DC"

names(MIXRSA)<-"Miami"

names(DAXRSA)<-"Dallas"

names(ATXRSA)<-"Atlanta"

names(SFXRSA)<-"San Francisco"

names(LXXRSA)<-"Los Angeles"

names(SEXRSA)<-"Seattle"

names(CSUSHPISA)<-"National"

Mortgage<-getSymbols('MORTGAGE30US', src='FRED')

Housing_Price=ATXRSA

Compare_Max=Housing_Price/max(Housing_Price)*100

Diff_Housing=Delt(Housing_Price,k=12)*100

Annual_Changes=annualReturn(Housing_Price)*100

par(mfrow=c(2,1))

plot(Diff_Housing)

plot(Annual_Changes)

summary(last(Annual_Changes,'7 years'))

describe(Annual_Changes)

par(mfrow=c(3,1))

plot(ATXRSA, main="ATLANTA")

plot(Delt(ATXRSA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(ATXRSA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

par(mfrow=c(3,1))

plot(BOXRSA, main="BOSTON")

plot(Delt(BOXRSA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(BOXRSA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

par(mfrow=c(3,1))

plot(CHXRSA, main="CHICAGO")

plot(Delt(CHXRSA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(CHXRSA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

par(mfrow=c(3,1))

plot(DAXRSA, main="DALLAS")

plot(Delt(DAXRSA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(DAXRSA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

par(mfrow=c(3,1))

plot(DNXRSA, main="DENVER")

plot(Delt(DNXRSA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(DNXRSA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

par(mfrow=c(3,1))

plot(LVXRSA, main="LAS VEGAS")

plot(Delt(LVXRSA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(LVXRSA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

par(mfrow=c(3,1))

plot(MIXRSA, main="MIAMI")

plot(Delt(MIXRSA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(MIXRSA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

par(mfrow=c(3,1))

plot(NYXRSA, main="NEW YORK")

plot(Delt(NYXRSA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(NYXRSA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

par(mfrow=c(3,1))

plot(SDXRSA, main="SAN DIEGO")

plot(Delt(SDXRSA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(SDXRSA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

par(mfrow=c(3,1))

plot(SEXRSA, main="SEATTLE")

plot(Delt(SEXRSA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(SEXRSA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

par(mfrow=c(3,1))

plot(SFXRSA, main="SAN FRANSICO")

plot(Delt(SFXRSA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(SFXRSA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

par(mfrow=c(3,1))

plot(WDXRSA, main="WASHINGTON DC")

plot(Delt(WDXRSA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(WDXRSA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

par(mfrow=c(3,1))

plot(CSUSHPISA, main="US NATIONAL")

plot(Delt(CSUSHPISA, k=12)*100, main="Percent changes from previous year ", col="red")

barplot(annualReturn(CSUSHPISA), main="Annual Changes ", col="blue", cex.names=0.8, las=2)

dev.off()

barplot(Annual_Changes, main=" Annual Changes ", col="blue", cex.names=0.8, las=2)

Monthly_Price<-monthlyReturn(Housing_Price)

Monthly_Rate<-MORTGAGE30US

Housing<-na.omit(merge(Monthly_Price,MORTGAGE30US))

head(Housing)

# Scatter chart for Price chagnes

scatter.smooth(last(Housing, "10 years"))

abline(lm(Housing$monthly.returns~Housing$MORTGAGE30US), col="blue")

# Regressiion Model

alli.mod1=lm(Combined$monthly.returns~Combined$MORTGAGE30US, data=Combined)

summary(alli.mod1)

autoplot(MORTGAGE30US)

y<-(Housing_Price)

library(ggfortify)

library(forecast)

autoplot(y)

d.arima<-auto.arima(y)

d.arima

d.forecast<-forecast(d.arima)

d.forecast

autoplot(forecast(d.arima, 36))

fit<-ets(y)

autoplot(stl(y, plot=FALSE))

ggtsdiag(auto.arima(y))

autoplot(forecast(fit,36))

Housing_Prices <- as.xts(data.frame(

NYXRSA,

BOXRSA,

SDXRSA,

CHXRSA,

DNXRSA,

LVXRSA,

WDXRSA,

MIXRSA,

LXXRSA,

SFXRSA

))

Housing_return = apply(Housing_Prices, 1, function(x) {x / Housing_Prices[1,]}) %>%

t %>% as.xts

head(Housing_return)

Summary_Stat<-summary(Housing_return)

cor(Housing_return)

write.table(Summary_Stat, "Summary.xls")

plot(as.zoo(Housing_return), screens = 1, lty = 1:10, xlab = "Date", ylab = "Home Price Index")

legend("topleft", c("New York", "Boston", "San Diego","Chicago",

"Denver", "Las Vegas","DC",

"Miami", "Los Angeles", "San Francisco"), lty = 1:10, cex = 0.5)

plot(Housing_return, xlab = "Date", ylab = "Index (1987=100)")

legend("right", c("New York", "Boston", "San Diego","Chicago",

"Denver", "Las Vegas","DC",

"Miami","Los Angeles","San Francisco"),

fill=c("blue","red","green","black","sky blue","purple","yellow",

"white", "black","red"

) )

ggplot(Housing_return, aes( x=))

tail(Housing_return)

Wednesday, May 12, 2021

U.S. Consumer Price Index (CPI) Analysis as of 04-2021

library(Quandl)

library(ggplot2)

library(tseries);library(timeseries);library(xts);library(forecast)

library (quantmod)

library(psych)

library(plotly) #install.package(plotly)

#Food and Beverages (CPIFABSL)

#Housing (CPIHOSNS)

#Apparel (CPIAPPSL)

#Transportation (CPITRNSL)

#Medical Care (CPIMEDSL)

#Recreation (CPIRECSL)

#Education and Communication (CPIEDUSL)

# Other Goods and Services (CPIOGSSL)

#Commodities (CUSR0000SAC)

# Services (CUSR0000SAS)

start <- as.Date("1990-01-01")

getSymbols(c('CPIFABSL','CPIHOSNS','CPIAPPSL','CPITRNSL','CPIMEDSL','CPIRECSL',

'CPIEDUSL','CPIOGSSL','CUSR0000SAC','CUSR0000SAS',"CPIAUCSL","CPILFESL"), from=start, src='FRED')

CPI<-merge (CPIFABSL,CPIHOSNS,CPIAPPSL,CPITRNSL,CPIMEDSL,CPIRECSL,

CPIEDUSL,CPIOGSSL,CUSR0000SAC,CUSR0000SAS,CPIAUCSL,CPILFESL)

Diff_CPI <- (CPI/lag(CPI)-1)*100

Diff_CPI[1,] <- 0

Diff_CPIAUCSL=Delt(CPIAUCSL,k=12)*100

Diff_CPIFESL=Delt(CPILFESL,k=12)*100

Diff_CPIFABSL=Delt(CPI$CPIFABSL,k=12)*100

Diff_CPIHOSNS=Delt(CPI$CPIHOSNS,k=12)*100

Diff_CPIAPPSL=Delt(CPI$CPIAPPSL,k=12)*100

Diff_CPITRNSL=Delt(CPI$CPITRNSL,k=12)*100

Diff_CPIMEDSL=Delt(CPI$CPIMEDSL,k=12)*100

Diff_CPIRECSL=Delt(CPI$CPIRECSL,k=12)*100

Diff_CPIEDUSL=Delt(CPI$CPIEDUSL,k=12)*100

Diff_CPIOGSSL=Delt(CPI$CPIOGSSL,k=12)*100

Diff_CUSR0000SAC=Delt(CPI$CUSR0000SAC,k=12)*100

Diff_CUSR0000SAS=Delt(CPI$CUSR0000SAS,k=12)*100

Diff_12<-merge(Diff_CPIFABSL, Diff_CPIHOSNS, Diff_CPIAPPSL, Diff_CPITRNSL,

Diff_CPIMEDSL, Diff_CPIRECSL, Diff_CPIEDUSL, Diff_CPIOGSSL,

Diff_CUSR0000SAC, Diff_CUSR0000SAS)

Diff_12=window(Diff_12,start=as.Date("2001-01-01"), end=as.Date("2020-12-31"))

cor.distance <- cor(Diff_12)

corrplot::corrplot(cor.distance)

plot(Diff_CPIAPPSL)

plot(Diff_12)

plot(Diff_CPIAUCSL, main='Changes from previous year -CPI for All',las=2, subset='2000-01-01/')

plot(Diff_CPIFESL, main='Changes from previous year - Core CPI',las=2,subset='2000-01-01/')

plot(Diff_CPIFABSL, main='Changes from previous year -Food and Beverage',las=2, subset='2000-01-01/')

plot(Diff_CPIHOSNS, main='Changes from previous year -Housing',las=2,subset='2000-01-01/')

plot(Diff_CPIAPPSL, main='Changes from previous year -APPAREL', las=2,subset='2000-01-01/')

plot(Diff_CPITRNSL, main='Changes from previous year -Transportation',las=2,subset='2000-01-01/')

plot(Diff_CPIMEDSL, main='Changes from previous year -Medical Care',las=2,subset='2000-01-01/')

plot(Diff_CPIRECSL, main='Changes from previous year -Recreation',las=2,subset='2000-01-01/')

plot(Diff_CPIEDUSL, main='Changes from previous year -Education and Communication',las=2,subset='2000-01-01/')

plot(Diff_CPIOGSSL, main='Changes from previous year -Other Goods and Services',las=2,subset='2000-01-01/')

plot(Diff_CUSR0000SAC, main='Changes from previous year -Commodities',las=2,subset='2000-01-01/')

plot(Diff_CUSR0000SAS, main='Changes from previous year -Services',las=2,subset='2000-01-01/')

Subscribe to:

Comments (Atom)