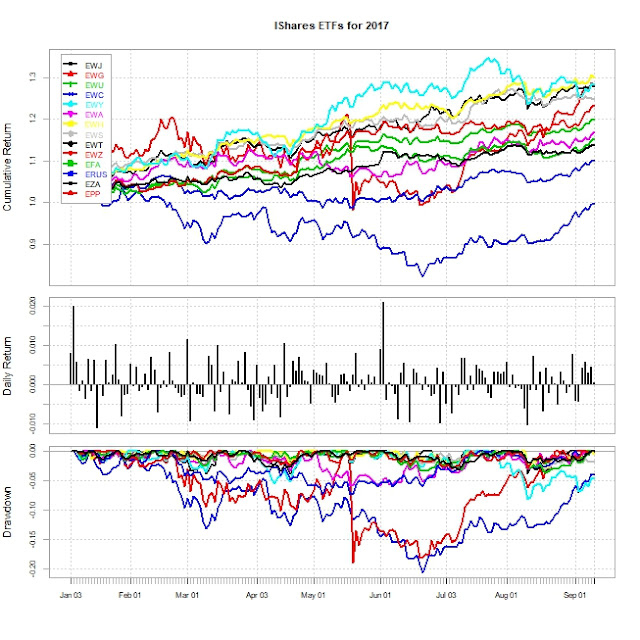

The following chart shows the 2017 performance charts of

"EWJ", #iShares Japan

"EWG", #iShares Germany

"EWU", #iShares UK

"EWC", #iShares Canada

"EWY", #iShares South Korea

"EWA", #iShares Australia

"EWH", #iShares Hong Kong

"EWS", #iShares Singapore

"EWT", #iShares Taiwan

"EWZ", #iShares Brazil

"EFA", #iShares EAFE

"ERUS", #iShares Russia

"EZA", #iShares South Africa

"EPP" #iShares Pacific Ex Japan

Performances of ETFs as of 9-12-207 (from 1-1-2017)

|

The following chart shows how annualized returns and risks have been moving during 2017.