library(zoo)

library(quantmod)

library(TTR)

library(forecast)

library(ggfortify)

library(psych)

library(pastecs)

library(xts)

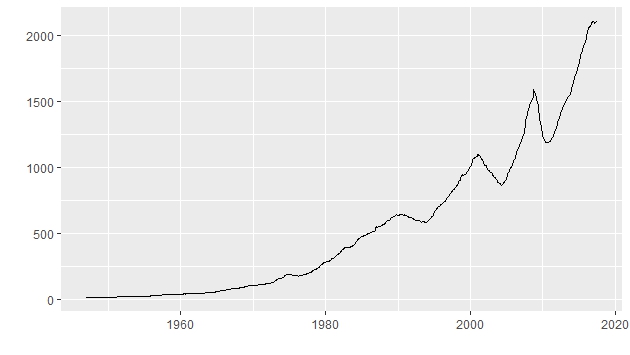

getSymbols('INDPRO', src='FRED')

mydata=INDPRO

Annual<-annualReturn(mydata)*100

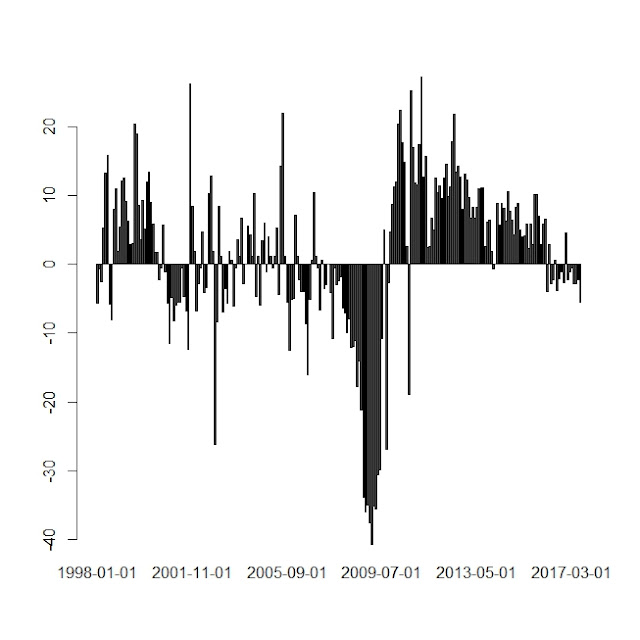

barplot(last(Annual, '20 year'), main='Annual Changes')

tail(Annual)

yearly.returns

2012-12-01 2.3161888

2013-12-01 2.0991660

2014-12-01 3.1831880

2015-12-01 -3.2541923

2016-12-01 0.8255124

2017-07-01 1.6461802 (as of July 2017)

# Annual changes from 1998 to July 2017

the industrial production index increased by 1.65% in 2017 as of July 2017.

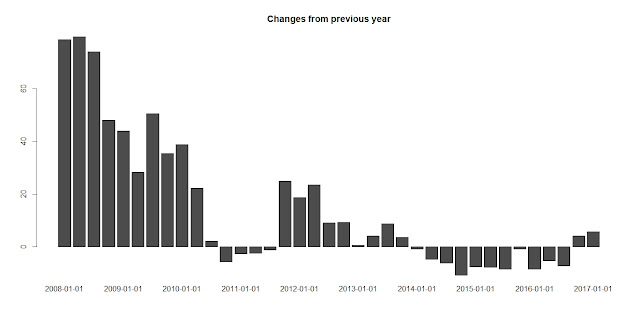

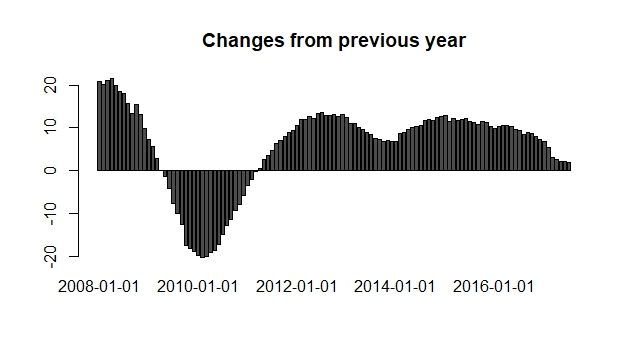

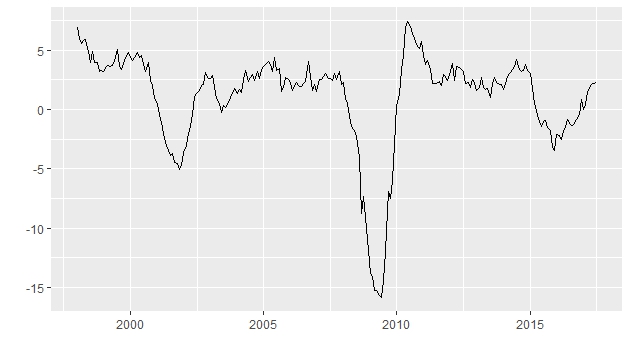

Diff_Year=diff(mydata,lag=12)

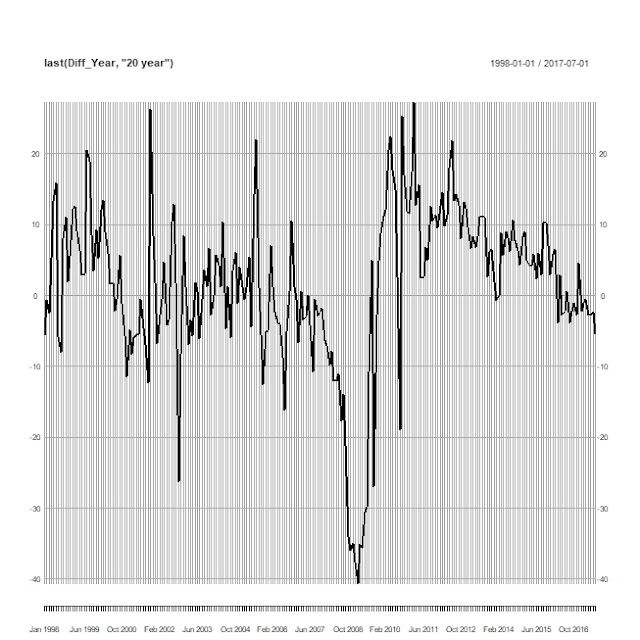

barplot(last(Diff_Year, '20 year'))

Industrial production index begins to increase positively from January 2017.

autoplot(last(Diff_Year, '20 year'))

summary(last(Diff_Year, '20 year'))

Index INDPRO

Min. :1998-01-01 Min. :-15.8834

1st Qu.:2002-11-16 1st Qu.: 0.0678

Median :2007-10-01 Median : 2.2094

Mean :2007-10-01 Mean : 1.0568

3rd Qu.:2012-08-16 3rd Qu.: 3.3462

Max. :2017-07-01 Max. : 7.4406

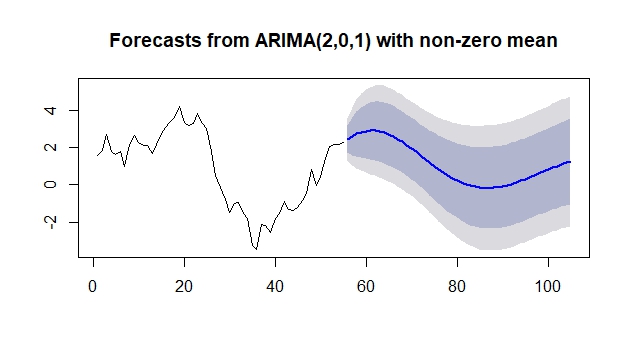

#forecasting

fit<-arima(last(Diff_Year, '5 year'), order=c(2,0,1))

accuracy(fit)

forecast(fit,50)

plot(forecast(fit,50))

Source:

https://fred.stlouisfed.org/series/INDPRO