In American history, Bimetallism in the late nineteenth century was a political movement that advocated the use of silver as a monetary standard in addition to gold. The farmers, especially the wheat and cotton belts (midwest), supported the peritoneal decay because they felt that the inflation would have lowered their debts and favored the economy. Also, the silver miners in the western United States have supported the decadent to ensure the value of silver.

Perhaps the emergence of bitcoin has many similarities with the Bimetallism situation. Bitcoin supporters are Silicon Valley technology companies that are benefited from bitcoin and those who are Libertarian and Occupy Wall Street supporters. In economics, you use both gold and silver as the second-tier money and use a statutory price ratio. However, the peritoneal preparation is generally very unstable. This is similar to the high volatility of bitcoin prices.

Due to changes in the commercial value of metals, metals at a commercial price lower than the legally fixed price will be used for money and other metals will be withdrawn from currency circulation. (The general principle governing this is called the law of Gresham.) The price of gold is higher than the price of silver so silver would have eventually driven out of gold and silver used as currency. Now, even if a bitcoin is a threat to value, it is higher than gold or dollar, so it is difficult to use it as currency, and it is not a threat to the dollar as currency. Satoshi Nakamoto originally wanted the bitcoin to be used as currency, but it seems difficult to be used as currency at the current price.

In 1873, however, the Coinage Act of 1973 ended the role of the silver coin, with the exception of small coins. (The so-called 1983 massacre (or The Crime of 1873)). Because gold was inexpensive and cheap, Silverlight (and its proponents) put a lot of effort into rebuilding it to inflate and damage gold monopolies. This is now Satoki Nakamoto developed bitcoin to check Wall Street that dominates the financial sector. Those who insist on this subject force the US Treasury Department to buy silver, but efforts to make silver money have failed. Perhaps the advantage is that the forces that are trying to make the bitcoin a legal currency need to know.

The biplane controversy arises because the United States was predominantly in the United States in the late 19th century when the United States was the only major country in the world to be a large producer of gold and silver. So the decile was a key issue in American politics in the 1890s. The supporters of both sides (the Goldbraists vs. the Silverbongers) showed an abnormally high level of criticism because they viewed themselves as supporters of morality and the other as malice and danger. This seems to be similar to what the bitcoin supporters of today are seeing the financial sector of Wall Street as the evil of the financial crisis. And it is similar to looking at buying a bitcoin in the financial sector.

Newly discovered silver in the western United States enriched cheap silver, but in 1873 Congress passed the Coinage Act in 1873. Smaller silver is allowed, but it is no longer legal for large debts. This was later accused by the Silverites of "a 73-year crime" because it was judged by the government to prevent inflation. The city is trading in the market at 35: 1 compared to gold, so the farmers with high debt could buy the silver cheaply, cast it into silver and pay it back to the bank, which is forbidden by law. Improvements in rail transport mean that farmers are getting cheaper to transport grain to Europe and the farmers' debt has increased as they have over-extended production until they thrive in the market.

In 1890, when the Silverman Act of 1890 passed, the US Treasury issued bonds that could be repurchased in gold or silver, prompting a silver site that requires the Treasury to purchase 4.5 million ounces of silver each month. This caused some inflation. Since the money we were using at the time was being changed from coins and paper to bank checks, the money supply was greatly expanded. In 1890 the ratio at the mine was 20: 1 (silver was 20 ounces equal to one ounce of gold). The overproduction of silver fell to 35: 1 in the mid-1890s. That is, the market value of silver has fallen. However, the panic in 1893 was a serious national recession that drove the money problem to the fore. Silverlight (those around Eunbung) demanded money at a rate of 16: 1 by the government. They hoped that this would sprinkle the country with silver, raise prices and reduce old debt due to incentives.

Silverites argue that the use of silver inflates the money supply and equals prosperity by providing more cash for everyone. This is the opposite of what the current bitcoin claims. Current bitcoin advocates are opposed to the diminution of the value of the legal currency due to banks' irresponsible money supply. Gold supporters say that silver will permanently slow down the economy, but sound money made by the gold standard will restore prosperity. William Jennings Bryan defeated Democratic Party of Bourbon in 1894 and supported Democratic leadership with the support of the Revolutionary Party and Silverlight. And he was appointed a president candidate by the Democratic Party. Against this backdrop, the Republican Party nominated William McKinley as the presidential candidate in his party's seat to support Wall Street's favorite gold nomination.

It was promised that silver would bring utopia for workers in 1893. It is similar to what Libertarian now believes Bitcoin will bring freedom from the financial sector. Bryan argued that "tens of thousands of gold standards have been killed" in a speech at the National Democratic National Convention on July 9, 1896, in a famous "Gold of Cross" speech. He said, "idle holders of idle capital" and "masses who make riches and pay taxes" and my friends, the questions we have to decide are: Which will the Democrats fight? " Do not push your eyebrows into this crown. Do not crucify the human race on the cross of gold. "But Bryan lost his election to Republican William McKinley with a big difference in the numbers. He tried again in 1900 and lost his economy again because the economy had completely collapsed. The Democratic Party abandoned Silverlight (Silverlight), and when Brian challenged Bryan for the third time in 1908, he did not mention bimetallism anymore. Now, the Silicon Valley technology companies representing the West and the East, It is not easy to predict what the outcome will be, but the US government will not ban the coin for the time being as if it abolished silver.

My objective is to simplify and clarify economics, making it accessible to everyone. It is important to remember that the opinions expressed in my writing are solely my own and should not be considered as financial advice. Any potential losses incurred from acting upon the information provided in my writing are the responsibility of the individual, and I cannot be held liable for them.

Translate

Thursday, October 19, 2017

Tuesday, October 17, 2017

IT Industry vs. Banking Industry battle through Bitcoin

Looking at the phenomenon of bitcoin, it reminds me of Internet stock bubble at the end of the 1990s. At that time, Internet-related stocks rose greatly and power and money moved to Silicon Valley in West from Wall Street in East. Because the Fed raised the interest rates rapidly, the Internet stock bubble eventually collapsed, and Nasdaq has had a long break for almost eight years. After the internet stocks bubble collapsed, the real estate was booming and shares of U.S. financial sector marched high altitude. In fact, real estate and banks have no significant impact on the real economy.

However, the financial crisis in 2007-08, the real estate collapsed and Wall Street's financial industry received government reliefs and government regulation together. While the stocks of financial companies crawled during the past ten years, Amazon, Google, Facebook High-tech shares rose greatly again, and the top six companies of the most valued companies are high-tech companies (Google, Apple, Microsoft, Amazon and Facebook) .

Along with that, the human resources, capital and power of the United States are moving to tSilicon Valley in west in the eastern from Wall Street in east part of the United States. The winning of the trump 's presidental election and the Wall Street began to fight back. The wall street still holds the financial hegemony at this time.

he financial institutions are trying to dismantle the Volcker's rule in the Dodd-Frank Act. In addition, the Federal Reserve has been trying to raise interest rates carefully again. It is raising the bank's net profits of banks and stocks of banks are gradually rising again.

However, as the short-term interest rate rises and the long-term interest rate declines, the economy will again enter a recession, so the Fed is trying to raise the long-term interest rates through quantitative reductions.

The appearance of bitcoins at the peak of the great recession is a threat to Wall Street banks, but it is the best ally for Silicon Valley IT companies. The hegemony of finance will be split between Wall Street banks and IT companies in Silicon Valley due appearance of bitcoin. There are a lot of US IT companies getting benefits from booming of bitcoins. Typical examples are NVIDIA (NVDA) and Overstock.com (OSTK).

Among the forces that influence the political world in the United States, the power comparison of the Wall Street of the financial institutions' hegemon and Silicon Valley represented by the IT company has been transferred to the bitcoin. It seems that the US government will not easily sanction bitcoins. In addition, although Amazon does not receive bitcoins yet, Overstock.com suddenly becomes hot stock while amazon watching the stock price of Overstock.com rises in only a few months, it will start to receive bitcoins eventually, and the influence of bitcoin further expands.

However, the financial crisis in 2007-08, the real estate collapsed and Wall Street's financial industry received government reliefs and government regulation together. While the stocks of financial companies crawled during the past ten years, Amazon, Google, Facebook High-tech shares rose greatly again, and the top six companies of the most valued companies are high-tech companies (Google, Apple, Microsoft, Amazon and Facebook) .

Along with that, the human resources, capital and power of the United States are moving to tSilicon Valley in west in the eastern from Wall Street in east part of the United States. The winning of the trump 's presidental election and the Wall Street began to fight back. The wall street still holds the financial hegemony at this time.

he financial institutions are trying to dismantle the Volcker's rule in the Dodd-Frank Act. In addition, the Federal Reserve has been trying to raise interest rates carefully again. It is raising the bank's net profits of banks and stocks of banks are gradually rising again.

However, as the short-term interest rate rises and the long-term interest rate declines, the economy will again enter a recession, so the Fed is trying to raise the long-term interest rates through quantitative reductions.

The appearance of bitcoins at the peak of the great recession is a threat to Wall Street banks, but it is the best ally for Silicon Valley IT companies. The hegemony of finance will be split between Wall Street banks and IT companies in Silicon Valley due appearance of bitcoin. There are a lot of US IT companies getting benefits from booming of bitcoins. Typical examples are NVIDIA (NVDA) and Overstock.com (OSTK).

Among the forces that influence the political world in the United States, the power comparison of the Wall Street of the financial institutions' hegemon and Silicon Valley represented by the IT company has been transferred to the bitcoin. It seems that the US government will not easily sanction bitcoins. In addition, although Amazon does not receive bitcoins yet, Overstock.com suddenly becomes hot stock while amazon watching the stock price of Overstock.com rises in only a few months, it will start to receive bitcoins eventually, and the influence of bitcoin further expands.

Wednesday, September 13, 2017

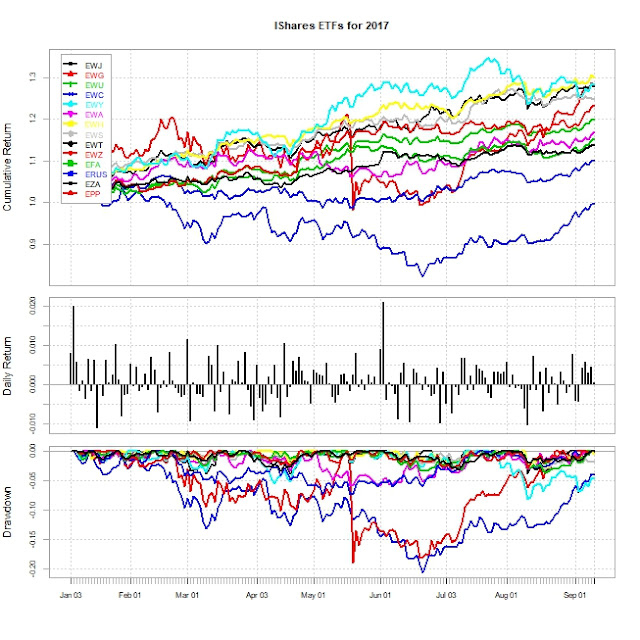

IShares ETFs from 1-1-2017 to 9-12-2017

The following chart shows the 2017 performance charts of

"EWJ", #iShares Japan

"EWG", #iShares Germany

"EWU", #iShares UK

"EWC", #iShares Canada

"EWY", #iShares South Korea

"EWA", #iShares Australia

"EWH", #iShares Hong Kong

"EWS", #iShares Singapore

"EWT", #iShares Taiwan

"EWZ", #iShares Brazil

"EFA", #iShares EAFE

"ERUS", #iShares Russia

"EZA", #iShares South Africa

"EPP" #iShares Pacific Ex Japan

Performances of ETFs as of 9-12-207 (from 1-1-2017)

|

The following chart shows how annualized returns and risks have been moving during 2017.

Sunday, September 10, 2017

Analyzing iShares ETFs from January 2003

iShares ETFs

"EWJ", #iShares Japan

"EWG", #iShares Germany

"EWU", #iShares UK

"EWC", #iShares Canada

"EWY", #iShares South Korea

"EWA", #iShares Australia

"EWH", #iShares Hong Kong

"EWS", #iShares Singapore

"EWT", #iShares Taiwan

"EWZ", #iShares Brazil

"EFA", #iShares EAFE

"EPP" #iShares Pacific Ex Japan

"EWJ", #iShares Japan

"EWG", #iShares Germany

"EWU", #iShares UK

"EWC", #iShares Canada

"EWY", #iShares South Korea

"EWA", #iShares Australia

"EWH", #iShares Hong Kong

"EWS", #iShares Singapore

"EWT", #iShares Taiwan

"EWZ", #iShares Brazil

"EFA", #iShares EAFE

"EPP" #iShares Pacific Ex Japan

| EWJ | EWG | EWU | EWC | EWY | EWA | EWH | EWS | EWT | EWZ | EFA | EPP | ||

| Annualized | Return | 5.9% | 10.1% | 6.1% | 9.4% | 10.2% | 11.3% | 11.5% | 11.2% | 8.2% | 15.0% | 7.6% | 11.1% |

| Annualized | Std | 21.9% | 26.2% | 23.5% | 22.6% | 32.4% | 27.9% | 25.4% | 25.4% | 27.7% | 37.8% | 22.2% | 25.3% |

| Annualized | Sharpe | 0.2431 | 0.3646 | 0.2375 | 0.3933 | 0.2976 | 0.383 | 0.431 | 0.4197 | 0.2756 | 0.3807 | 0.3197 | 0.4177 |

Saturday, September 9, 2017

Currencies from January 1995 to September 2017

The following chart shows the performances of currencies from January 1995 to September 2017

The Korean Won has been depreciating at 1.6% annually against dollar.

|

The following chart shows the diagram of correlation matrix among currencies.

Thursday, September 7, 2017

SPDR Sector ETFs Analysis

There are eight SPDR sector ETFs :

"XLB", #SPDR Materials sector

"XLE", #SPDR Energy sector

"XLF", #SPDR Financial sector

"XLP", #SPDR Consumer staples sector

"XLI", #SPDR Industrial sector

"XLU", #SPDR Utilities sector

"XLV", #SPDR Healthcare sector

"XLK", #SPDR Tech sector

"XLY", #SPDR Consumer discretionary sector

the following chart shows the performances of SPDR sector ETFs from January 2003 and: XLU (Utilities sector) and XLK (Tech sector) have the highest cumulative returns.

Consumer staples sector (XLP) seems to be the best investment. (Annualized return:9.65% with Sharpe ratio is 0.7015)

"XLE", #SPDR Energy sector

"XLF", #SPDR Financial sector

"XLP", #SPDR Consumer staples sector

"XLI", #SPDR Industrial sector

Tree Chart

"XLB", #SPDR Materials sector

"XLE", #SPDR Energy sector

"XLF", #SPDR Financial sector

"XLP", #SPDR Consumer staples sector

"XLI", #SPDR Industrial sector

"XLU", #SPDR Utilities sector

"XLV", #SPDR Healthcare sector

"XLK", #SPDR Tech sector

"XLY", #SPDR Consumer discretionary sector

XLF (Finance sector) is connected to XLU (Utilities sector) and XLE (Energy sector)

"XLB", #SPDR Materials sector

"XLE", #SPDR Energy sector

"XLF", #SPDR Financial sector

"XLP", #SPDR Consumer staples sector

"XLI", #SPDR Industrial sector

"XLU", #SPDR Utilities sector

"XLV", #SPDR Healthcare sector

"XLK", #SPDR Tech sector

"XLY", #SPDR Consumer discretionary sector

the following chart shows the performances of SPDR sector ETFs from January 2003 and: XLU (Utilities sector) and XLK (Tech sector) have the highest cumulative returns.

Consumer staples sector (XLP) seems to be the best investment. (Annualized return:9.65% with Sharpe ratio is 0.7015)

| XLB | XLE | XLF | XLP | XLI | XLU | XLV | XLK | XLY | ||

| Annualized Return | 0.0942 | 0.0935 | 0.0598 | 0.0965 | 0.104 | 0.1117 | 0.0948 | 0.1095 | 0.1089 | |

| Annualized Std Dev | 0.2352 | 0.2767 | 0.3182 | 0.1298 | 0.2009 | 0.1724 | 0.1604 | 0.2 | 0.2048 | |

| Annualized Sharpe (Rf=0.5%) | 0.3772 | 0.3181 | 0.1712 | 0.7015 | 0.4905 | 0.6158 | 0.5567 | 0.5197 | 0.5045 |

Correlation Matrix Chart

"XLB", #SPDR Materials sector"XLE", #SPDR Energy sector

"XLF", #SPDR Financial sector

"XLP", #SPDR Consumer staples sector

"XLI", #SPDR Industrial sector

Tree Chart

"XLB", #SPDR Materials sector

"XLE", #SPDR Energy sector

"XLF", #SPDR Financial sector

"XLP", #SPDR Consumer staples sector

"XLI", #SPDR Industrial sector

"XLU", #SPDR Utilities sector

"XLV", #SPDR Healthcare sector

"XLK", #SPDR Tech sector

"XLY", #SPDR Consumer discretionary sector

XLF (Finance sector) is connected to XLU (Utilities sector) and XLE (Energy sector)

Thursday, August 31, 2017

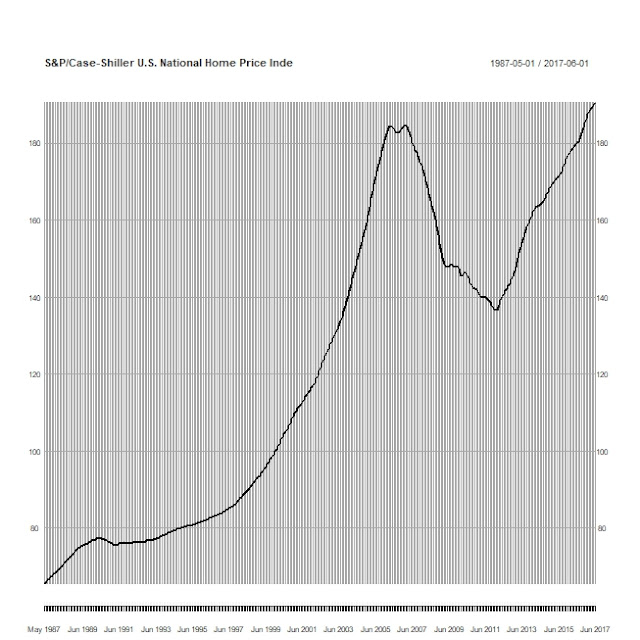

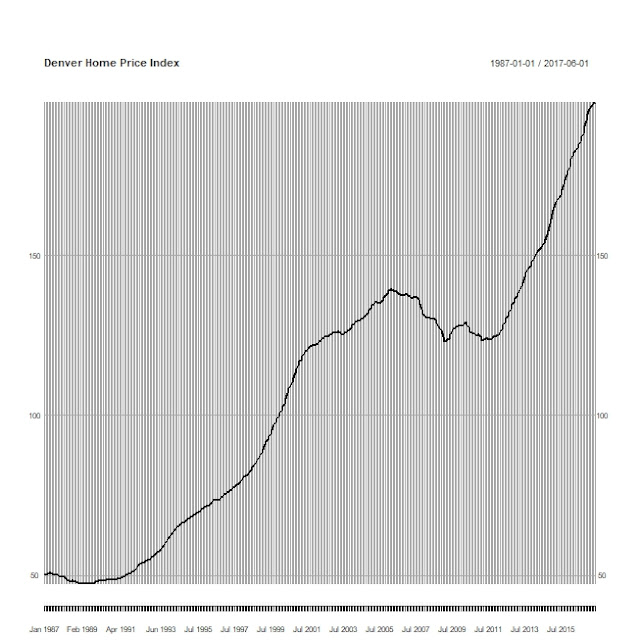

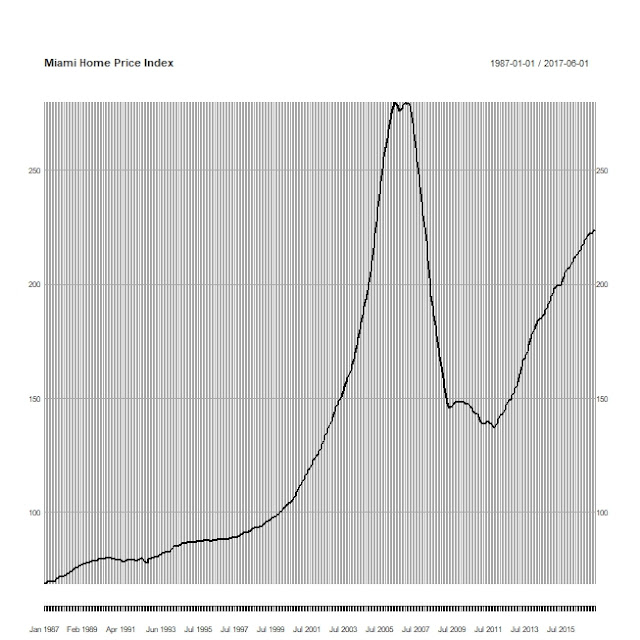

S&P/Case-Shiller MSA Home Price Index (Seasonal Adjusted) (1987/01/01=1.00) as of 6/2017

The following charts display the S&P/Case-Shiller MSA Home price Index (1987/01/01 =1.00) of several cities in the United States as of June, 2017. The home prices in many cities recover from the bottom caused by the financial crisis in 2007.

If you have purchased a home with $100K in the following cities in January 1987, then the value of house would be as of June 2017

San Fransco (506 K) > Los Angeles (439K ) > San Diego (438 K) > Denver (392K) > DC (341K) > Miami (327K)> Boston (284K) > Chicago (255K) > New York(254K) > Las Vegas (243K)

Source: http://us.spindices.com/index-family/real-estate/sp-corelogic-case-shiller

If you have purchased a home with $100K in the following cities in January 1987, then the value of house would be as of June 2017

San Fransco (506 K) > Los Angeles (439K ) > San Diego (438 K) > Denver (392K) > DC (341K) > Miami (327K)> Boston (284K) > Chicago (255K) > New York(254K) > Las Vegas (243K)

Source: http://us.spindices.com/index-family/real-estate/sp-corelogic-case-shiller

Tuesday, August 29, 2017

Ratios of U.S. corporate profits by industry

| The following chart shows the correlation matrix of ratios of profits by industry in total domestic profit. The finance industry is positively correlated with retail industry and is negatively correlated with other industries. The manufacturing industry is positively correlated with transportation and wholesale industries and is negatively correlated with retail. The transportation industry is positively correlated with the manufacturing industry. The information industry is positively correlated with the transportation industry. |

| The following chart shows the historical ratios of profits by industry in total U.S. corporate profits. |

Monday, August 28, 2017

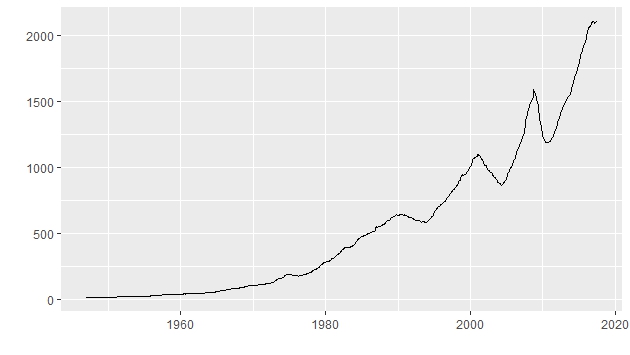

Corporate profits with inventory valuation and capital consumption adjustments: Rest of the world

The following chart shows the relationship between movements of dollar and U.S. corporate profits from rest of the world. They move opposite direction.

The profits of U.S. corporates from rest of the world had been increasing tremendously, but staying flat lately.

However, the growth rates of U.S. corporate profits from rest of the world had been slow down. It actually decreased from 2014 to 2016 when the Fed began to tighten the monetary policy.

The following chart shows the portion of U.S. corporate profits from rest of world in total U.S. corporate profits and it is growing which indicates the profits of U.S. corporates depend on more other countries.

Wednesday, August 23, 2017

Average Hourly Earnings of All employees

Six reasons why Average Houring Earnings are not rising fast

1. Boomers and Millennials - Higher-paid baby boomers are retiring and being replaced by younger and less experienced workers who start at lower salaries

2. Global labor market creates price controls - Americans are directly or indirectly competing in a worldwide pool of workers like never before.

3. "Price" Control -Not government-mandated controls, Stiff global competition caps U.S. wages by preventing companies from raising prices to cover higher labor costs

4.Technology progress - Technological advances have spawned a new revolution in business models that dramatically lower costs, including the price of labor

5.Recession scars -The great recession of 2007-2009 made Americans less secure and more fearful of losing their jobs, leading them to move around less frequently and be less aggressive in seeking higher pay.

6.Low productivity - productivity has been unusually weak. it grew an average of 1.1% from 20077 to 2016.

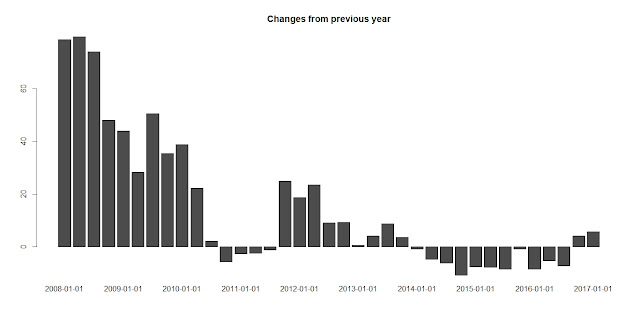

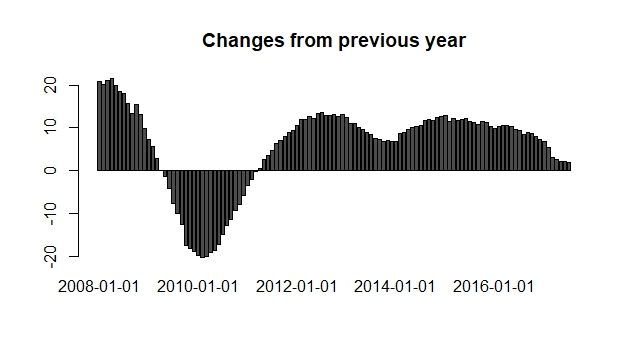

Annual Changes from same period in previous year

Annual Changes

|

| NOTE: For 2017, the data is as of July 2017 |

Source: https://fred.stlouisfed.org/series/CES0500000003

http://www.marketwatch.com/story/six-reasons-why-most-americans-arent-getting-big-pay-raises-2017-08-22

Tuesday, August 22, 2017

Sunday, August 20, 2017

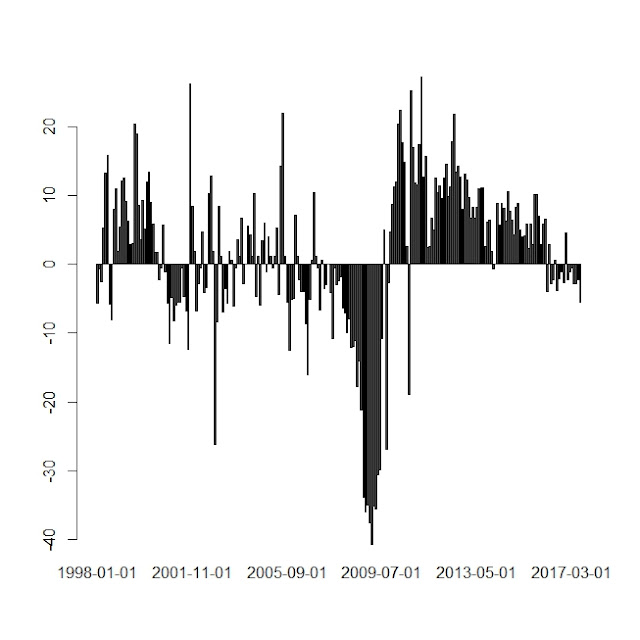

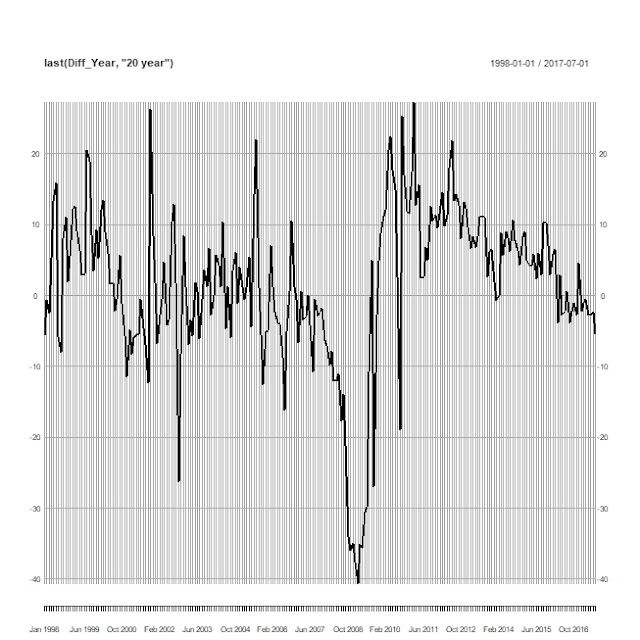

Commercial and Industrial Loans as of July 2017

Commercial and Industrial Loans

Commercial and Industrial Loans from previous month

Industrial and Commercial loans from previous year

Source: https://fred.stlouisfed.org/series/BUSLOANS#0

Saturday, August 19, 2017

Weibo Stock

요즈음 중국 IT 기업들의 주가가 미국의 FAANG (Facebook, Apple, Amazon, Netflix and Google) 보다 더 잘나가고 있습니다. 그중에 하나가 웨이보기업 (Weibo) 인데 작년까지 불가 $20 내외였는데 현재 $90 가까이 상승했습니다. 거의 4배가 올랐습니다.

Subscribe to:

Comments (Atom)