Introduction: The economic landscape is constantly evolving, shaped by various factors ranging from consumer spending to government investments. In this blog post, we delve into the real GDP growth rates for the fourth quarter of 2023, shedding light on key indicators such as Real Gross Domestic Product (GDP), Real Personal Consumption Expenditures, Real Exports and Imports of Goods and Services, as well as Real Government Consumption Expenditures and Gross Investment. Let's explore what these figures reveal about the state of the economy.

Real Gross Domestic Product (GDP): 3.30 Real GDP is a fundamental measure of a country's economic performance. In the fourth quarter of 2023, the Real GDP growth rate stood at 3.30%. This indicates a positive trajectory for the overall economic output, suggesting increased production and consumption of goods and services.

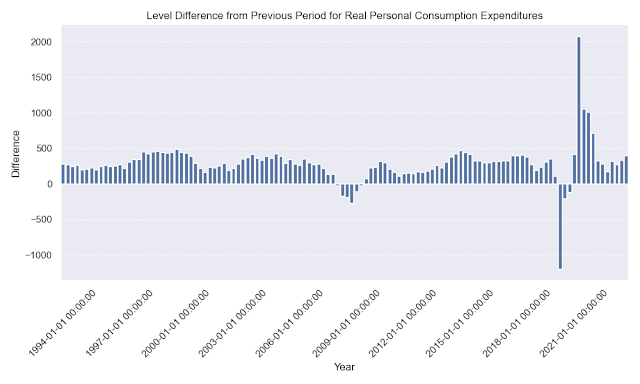

Real Personal Consumption Expenditures: 2.80 Consumer spending plays a pivotal role in economic growth. The Real Personal Consumption Expenditures (PCE) growth rate for Q4 2023 is recorded at 2.80%. This suggests that individuals are contributing significantly to economic expansion through their purchases of goods and services.

Real Exports of Goods and Services: 6.30 The international trade landscape is a crucial aspect of economic health. With a Real Exports growth rate of 6.30%, the fourth quarter of 2023 saw a substantial increase in the demand for goods and services produced domestically. This growth is indicative of a competitive global market.

Real Imports of Goods and Services: 1.90 While exports are crucial, so are imports, as they reflect the demand for foreign goods and services within the domestic market. The Real Imports growth rate for Q4 2023 is 1.90%, suggesting a moderate increase in the consumption of foreign products.

Real Government Consumption Expenditures and Gross Investment: 3.30 Government spending and investment contribute significantly to economic activity. In the fourth quarter of 2023, the Real Government Consumption Expenditures and Gross Investment grew by 3.30%, indicating a commitment to stimulating economic growth through public-sector initiatives.

Real Gross Private Domestic Investment: 2.10 Private sector investments are essential for sustained economic growth. The Real Gross Private Domestic Investment grew by 2.10% in Q4 2023, reflecting positive sentiment among businesses and investors.

Conclusion: In conclusion, the real GDP growth rates for the fourth quarter of 2023 paint a picture of a growing and dynamic economy. With positive indicators across various sectors, including personal consumption, exports, and government spending, the outlook is optimistic. However, it's important to monitor these trends over time to gain a comprehensive understanding of the economic landscape and identify potential challenges and opportunities.